Signature TimeFlies Options Strategy Training — Master Plenitude Trading’s Flagship TimeFlies Spread Through 20+ Structured Videos Combining Theory, Execution, Adjustments, And Real Trade Walkthroughs

Free Download TimeFlies Spread by Plenitude Trading – Includes Verified Content:

You Can Watch This Video Sample for Free to Know More Information:

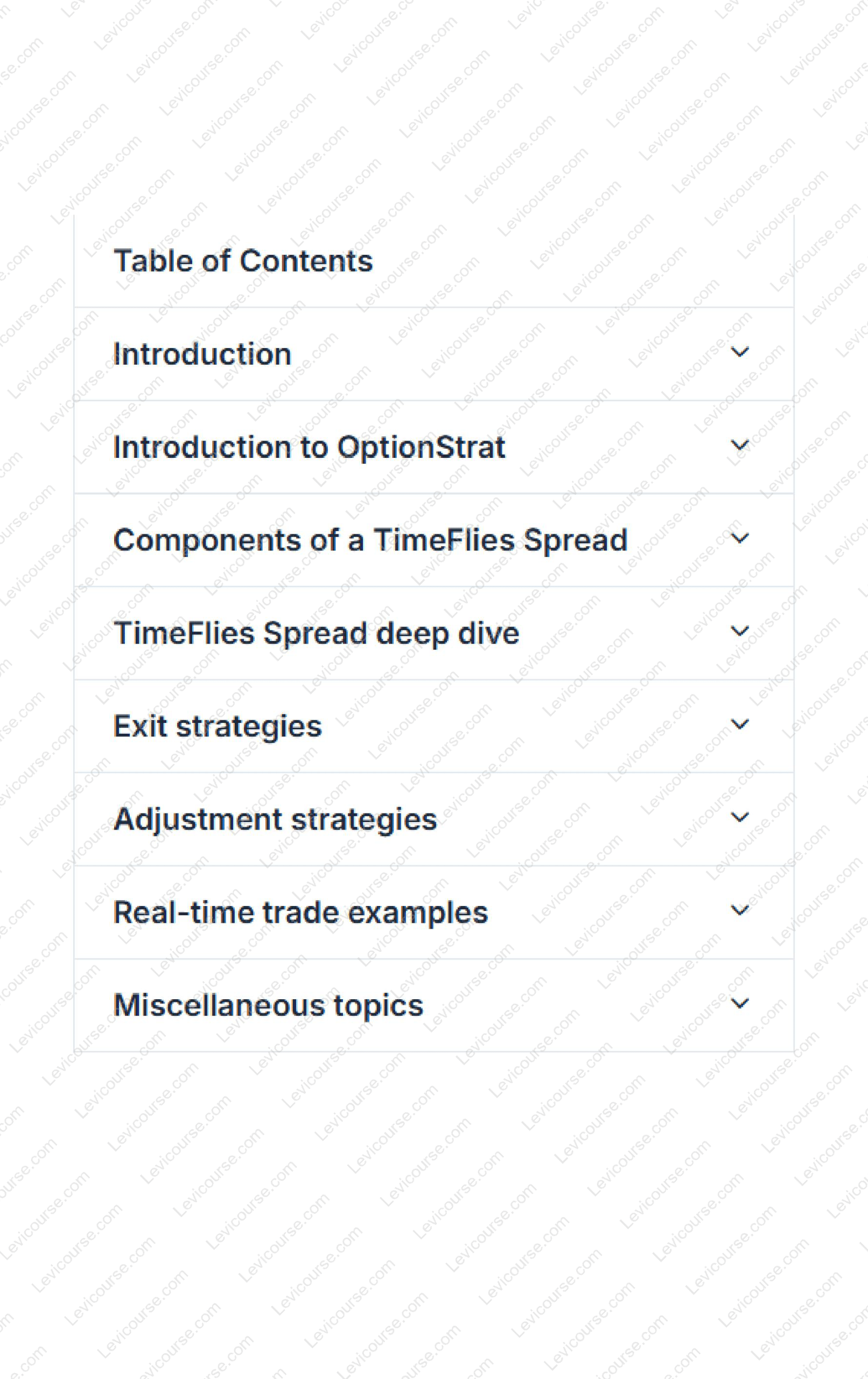

You Can Also Check The Content Proof below to Catch A Glimpse of The Content Inside:

TimeFlies Spread by Plenitude Trading – Master the Signature Options Strategy for Consistent, Controlled Income

The TimeFlies Spread by Plenitude Trading is a complete, step-by-step course dedicated to mastering the firm’s signature options strategy. With 20+ in-depth videos that blend theory, real-world examples, and practical execution, this course empowers you to confidently trade the TimeFlies Spread, manage risks, and maximize income — all at your own pace.

About the Program

The TimeFlies Spread isn’t just another options tactic — it is Plenitude Trading’s flagship strategy, refined through years of professional trading and coaching.

Unlike generic butterfly or calendar systems, the TimeFlies Spread blends the strengths of multi-expiration structures to deliver a more controlled risk profile, higher probability setups, and flexible adjustment paths.

Whether you’re a seasoned options trader or transitioning from simple spreads into more advanced tactics, this course breaks down the strategy in a way that’s clear, actionable, and easy to implement.

If you’ve ever felt overwhelmed by inconsistent results, unpredictable volatility shifts, or trouble managing positions after entry, this program gives you a repeatable framework that fills those gaps.

What You’ll Learn in This Awesome Course

This structured course contains 20+ premium videos, walking you through every component of the TimeFlies Spread — from setup to exit.

Here’s what’s included:

1. Understanding the Components of a TimeFlies Spread

You’ll start with a crystal-clear breakdown of the structure:

-

Why TimeFlies Spreads differ from traditional butterflies

-

How expiration selection impacts risk and reward

-

Strike alignment for optimal theta and vega balance

-

How to construct the spread efficiently using your broker

You’ll learn how each part of the structure interacts so you can avoid common pitfalls and understand why the trade works.

2. TimeFlies Spread Deep Dive

This is where you begin mastering the nuance.

The deep dive section focuses on:

-

How the position behaves through time

-

Ideal market conditions for deployment

-

How volatility expansion or contraction impacts the spread

-

Best underlying assets for consistent application

-

Optimal profit targets based on market behavior

This section ensures you understand market context and choose the strongest setups — the foundation of consistent success.

3. Exit Strategies (The Difference Between Profit and Pain)

Most traders know how to enter a position…but struggle to close it.

This module covers:

-

When to exit early to lock in gains

-

How to minimize risk with proactive exits

-

Profit-taking rules based on chart behavior and volatility

-

Identifying declining edge before it disappears

-

How to avoid overstaying the trade

Well-defined exits protect your capital. This module alone can save traders thousands in unnecessary losses.

4. Adjustment Strategies (Your Safety Net)

Even the best trades can move against you — but with the right adjustment strategies, you can stay in control.

You’ll learn:

-

How to adjust when price drifts toward a wing

-

Rolling techniques that preserve credit and reduce risk

-

When NOT to adjust (and why)

-

How time decay affects each adjustment path

-

Managing the position when volatility shifts unexpectedly

These techniques turn a losing setup into a manageable — or even profitable — position.

5. Real-Time Trade Examples

This is where theory meets real-world execution.

You’ll watch completed TimeFlies Spread trades from start to finish:

-

Why the trade was selected

-

How it was opened

-

How it behaved over time

-

What adjustments (if any) were made

-

How and when it was closed

-

Final profit/loss breakdown and lessons learned

Seeing the strategy applied in real markets helps unlock deeper understanding and trading confidence.

Why This Course Works

✔ Clear, Step-by-Step Learning

Each video builds on the previous one, allowing you to learn at your own pace without feeling overwhelmed.

✔ Real Trades, Not Hypotheticals

You see real charts, real entries, and real outcomes — including mistakes and fixes — not cherry-picked examples.

✔ Advanced Structure, Simplified

The TimeFlies Spread is a powerful strategy often misunderstood or misapplied. This course removes the guesswork so you can deploy it consistently.

✔ Perfect for Any Market

Combine theta decay + calendar logic + butterfly structure = flexibility in:

-

Low volatility

-

High volatility

-

Trend or range-bound conditions

Few strategies adapt this well.

✔ Focus on Risk-First Trading

You’ll learn how to:

-

Reduce risk

-

Control drawdowns

-

Maintain consistency

-

Build repeatable habits

This is exactly what long-term profitable options traders master.

Who This Course Is For

The TimeFlies Spread Course is ideal for Intermediate to advanced options traders, including:

-

Income-focused traders

-

Theta-based strategists

-

Butterfly and calendar traders

-

Traders seeking higher win rates with controlled risk

It’s also perfect for those who want to transition from simple vertical spreads into more sophisticated, higher probability setups.

If you want to become more confident, decisive, and systematic in your approach — this course will elevate your trading.

Course Features

-

⭐ 20+ High-definition training videos

-

⭐ Strategy breakdowns + practical examples

-

⭐ Trade adjustments + exit management

-

⭐ Real-time trade walkthroughs

-

⭐ Lifetime access for ongoing review

-

⭐ Learn on desktop, tablet, or mobile

-

⭐ Perfect pacing for self-directed study

You’re not just learning a strategy — you’re gaining a complete professional-level system for deploying and managing the TimeFlies Spread step-by-step.

Final Thoughts – Master a Signature Strategy That Delivers Real Consistency

The TimeFlies Spread by Plenitude Trading is more than just a course — it’s a roadmap to trading control, confidence, and consistency.

You’ll learn the exact structure that Plenitude Trading uses as their signature strategy, backed by detailed explanations and real trade examples.

If you’re tired of inconsistent results, wanting more precision in your entries and exits, or looking for a higher-probability income strategy — this course will become one of your most valuable trading tools.

👉 Join now and take the first step toward mastering the TimeFlies Spread with a structured, professional system designed for consistent, confident options trading results.

Reviews

There are no reviews yet.