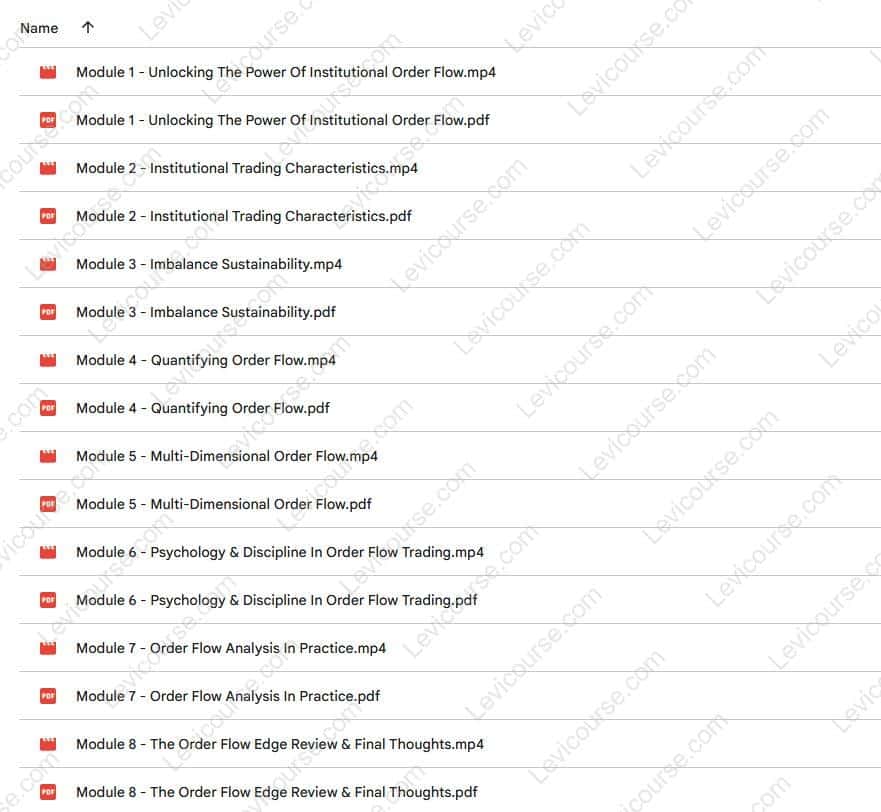

Free Download The Order Flow Edge Trading Course by Michael Valtos – Includes Verified Content:

The Order Flow Edge Trading Course by Michael Valtos – All About This Comprehensive 8-Module Masterclass By Institutional Trading Veteran Michael Valtos Which Teaches How To Decode And Trade Institutional Order Flow With Precision

The Order Flow Edge Trading Course by Michael Valtos – You Can Watch This Video Sample for Free to Know More Information:

The Order Flow Edge Trading Course by Michael Valtos – You Can Also View The PDF Sample below to Catch A Glimpse of The Content Inside:

The Order Flow Edge Trading Course by Michael Valtos – Master Institutional Order Flow and Trade Like the Pros

The Order Flow Edge Trading Course by Michael Valtos is a complete 8-module program that teaches traders how to interpret institutional order flow, identify imbalances, and leverage professional trading insights for consistent success. Learn directly from a former institutional trader with over 20 years of experience at JP Morgan, Cargill, and Commerzbank — and discover the real edge that drives market movements.

About the Course

If you’ve ever wondered why professional traders seem to always be one step ahead, the answer lies in institutional order flow — the real-time buying and selling activity that shapes every market move.

The Order Flow Edge is Michael Valtos’ definitive trading program, designed to help you unlock this powerful market advantage. With decades of institutional trading experience and as the creator of the industry-leading Orderflows Trader Software, Michael distills the principles and psychology behind professional order flow analysis into an actionable system anyone can learn.

Through eight structured modules, you’ll develop the ability to read the footprints of big players, quantify order imbalances, and execute with confidence — using the same techniques institutional traders rely on every day.

“Order flow isn’t just data — it’s the language of the market. Once you learn to read it, you’ll never trade blind again.”

— Michael Valtos

Why This Course Works

This program bridges the gap between conceptual understanding and real trading execution.

While many traders grasp order flow theory, few can translate it into consistent profits. This course teaches you how to do exactly that — through a combination of:

✅ Institutional insight – direct lessons from a trader with 20+ years of professional experience.

✅ Practical application – real-world case studies and chart examples.

✅ Psychological mastery – mindset, discipline, and risk management for long-term success.

By the end, you’ll not only understand order flow — you’ll see the market like an institution.

Who Is Michael Valtos?

Michael Valtos is one of the world’s foremost authorities on order flow trading.

With nearly two decades on the institutional side — trading for JP Morgan, Cargill, Commerzbank, and EDF Man — he brings a level of insight few retail traders ever access.

-

Former CME floor trader (Dean Witter, 1994).

-

Creator of Orderflows Trader Software, the industry standard for order flow analysis.

-

Speaker and educator at global trading conferences.

-

Trusted mentor to thousands of traders worldwide.

Michael combines institutional rigor with a teacher’s clarity — helping traders decode the market’s most authentic data source: order flow.

What You’ll Learn

This 8-module course is a step-by-step blueprint for mastering institutional order flow — from fundamentals to advanced multi-dimensional analysis.

Module 1 – Unlocking the Power of Institutional Order Flow

Learn what order flow truly is — and why it gives you a real-time edge in every market.

You’ll discover:

-

How institutional order flow moves prices.

-

The difference between professional and retail trading behavior.

-

How to recognize and interpret institutional footprints on your charts.

This module lays the groundwork for developing your “institutional mindset.”

Module 2 – Institutional Trading Characteristics

Explore the patterns, behaviors, and tactics that define institutional activity.

You’ll learn:

-

How institutions enter and exit positions without moving the market.

-

How to detect hidden liquidity and absorption events.

-

The telltale signs of algorithmic execution and volume clustering.

By spotting these patterns, you’ll anticipate large moves before they happen.

Module 3 – Imbalance Sustainability

Not all order imbalances are created equal.

This module teaches you how to identify the ones that matter — and ignore the noise.

You’ll learn:

-

How to spot sustainable imbalances that lead to trend continuation.

-

The difference between fleeting spikes and true institutional momentum.

-

How to build entry rules around order flow stability.

This skill alone can drastically improve your accuracy and risk-reward ratio.

Module 4 – Quantifying Order Flow

Order flow isn’t intuition — it’s measurable.

Here, you’ll master how to quantify buying and selling pressure using metrics and models.

You’ll learn:

-

How to measure delta, volume clusters, and imbalance ratios.

-

How to calculate market sentiment and momentum from flow data.

-

How to use data-driven filters to confirm trades objectively.

By the end, you’ll have tools to turn raw data into actionable insights.

Module 5 – Multi-Dimensional Order Flow

Go beyond one-dimensional reading of order flow.

You’ll discover how to combine multiple timeframes, participants, and markets for a complete picture.

This module covers:

-

How to analyze order flow contextually (scalping vs. swing).

-

Intermarket relationships and liquidity flow.

-

How to synthesize multiple data layers for confirmation.

This is how you evolve from a “chart watcher” into a true market analyst.

Module 6 – Psychology & Discipline in Order Flow Trading

Even the best strategy fails without emotional control.

Michael reveals how to master the mental side of trading order flow.

You’ll learn:

-

How to stay objective during volatile markets.

-

How to handle losses and protect confidence.

-

How to build discipline and stick to your plan.

-

Techniques for maintaining focus and composure under pressure.

You’ll finish this module thinking — and executing — like a professional trader.

Module 7 – Order Flow Analysis in Practice

Put theory into action through real-world case studies.

Michael walks you through live examples showing:

-

How institutional activity unfolds on footprint charts.

-

When to enter, manage, and exit based on flow signals.

-

How to interpret “hidden” clues in volume, delta, and liquidity zones.

This hands-on experience cements your understanding and sharpens your intuition.

Module 8 – The Order Flow Edge Review & Final Thoughts

Consolidate everything you’ve learned into a structured trading plan.

You’ll:

-

Review all key concepts and techniques.

-

Develop a personalized Order Flow Action Plan.

-

Learn how to integrate order flow into your existing systems.

This final module prepares you to trade independently — with clarity, precision, and confidence.

What Makes This Course Unique

Unlike other programs that teach surface-level indicators, The Order Flow Edge gives you:

-

An institutional perspective: Learn how professional traders think, not just what they see.

-

A proven curriculum: Structured progression from fundamentals to advanced application.

-

Actionable insights: Every lesson connects directly to real trading setups.

-

Psychological conditioning: Techniques to manage stress, discipline, and decision fatigue.

This is not theory — it’s the practical education every serious trader needs to gain a competitive edge.

Why You Should Join

By mastering the lessons in this course, you will:

✅ Understand the invisible forces that drive markets.

✅ Identify institutional buying and selling in real time.

✅ Filter out noise and trade with confidence.

✅ Gain a clear, repeatable strategy based on real data.

✅ Develop the mindset of an elite, disciplined trader.

Whether you’re a futures, forex, or equities trader, this course will redefine how you analyze and execute trades forever.

Who This Course Is For

-

Intermediate and advanced traders who want a deeper understanding of market microstructure.

-

Algorithmic or discretionary traders looking to improve precision and consistency.

-

Traders struggling with timing or false signals.

-

Anyone ready to think and trade like an institution, not a retail follower.

If you’ve been looking for a true professional trading edge, this is it.

The Result

After completing The Order Flow Edge Trading Course, you will:

✅ Read institutional order flow fluently.

✅ Quantify buying and selling pressure for better trade timing.

✅ Avoid traps and false signals in choppy markets.

✅ Manage trades with discipline and data-backed confidence.

✅ Consistently execute high-probability setups across market conditions.

You’ll no longer guess where the market is going — you’ll see it happening in real time.

Final Thoughts – The Professional’s Edge Starts Here

The Order Flow Edge Trading Course by Michael Valtos is your complete education in professional-grade order flow trading.

By learning how institutions move markets — and how to align with them — you’ll gain the clarity, precision, and edge needed to thrive in today’s competitive markets.

👉 Enroll today and start mastering the language of institutional order flow — your path to elite-level trading success.

Reviews

There are no reviews yet.