Free Download Tax-Free Living Course – Your Blueprint to Tax Free Living By Carter Cofield – Includes Verified Content:

Tax-Free Living Course – Your Blueprint to Tax-Free Living by Carter Cofield – All About This Complete Tax-Optimization And Wealth-Building Program By Carter Cofield

Tax-Free Living Course – Your Blueprint to Tax-Free Living by Carter Cofield – Watch This Video Sample for Free to Know More Information:

Tax-Free Living Course – Your Blueprint to Tax-Free Living by Carter Cofield – You Can Also View The PDF Sample below to Catch A Glimpse of The Content Inside:

Tax-Free Living Course – Your Blueprint to Tax-Free Living by Carter Cofield – And Finally, You Can Check The Content Proof Here:

Tax-Free Living Course – Your Blueprint to Tax-Free Living by Carter Cofield

The Tax-Free Living Course by Carter Cofield is a complete, step-by-step mentorship that teaches you how to legally minimize your taxes, transform your personal expenses into business deductions, and build long-term wealth through smart tax planning.

This program serves as your ultimate roadmap to keeping more of what you earn—helping entrepreneurs, business owners, and investors save $20,000–$100,000+ annually with proven IRS-approved strategies.

Why This Course Is Different

Most people view taxes as a burden—but wealthy individuals and successful business owners understand the tax code as a wealth-building tool.

The Tax-Free Living Course reveals how to use the tax system to your advantage, with simple, legal strategies that anyone can implement.

Here’s why this course stands out:

-

Designed by a CPA for Everyday People: Created by Carter Cofield, a licensed CPA and financial educator who specializes in helping entrepreneurs achieve financial freedom.

-

Comprehensive Curriculum: From tax deductions to real estate and investing, every strategy is explained step-by-step.

-

Action-Oriented: Includes calculators, examples, and walkthroughs you can apply immediately.

-

Updated for the Modern Economy: Learn strategies relevant to digital entrepreneurs, investors, and side hustlers.

-

Community & Mentorship: Access to ongoing workshops, webinars, and mentorship calls.

This course doesn’t just teach tax theory—it gives you a real-world playbook for living smarter, wealthier, and tax-efficiently.

What You’ll Learn in the Tax-Free Living Course

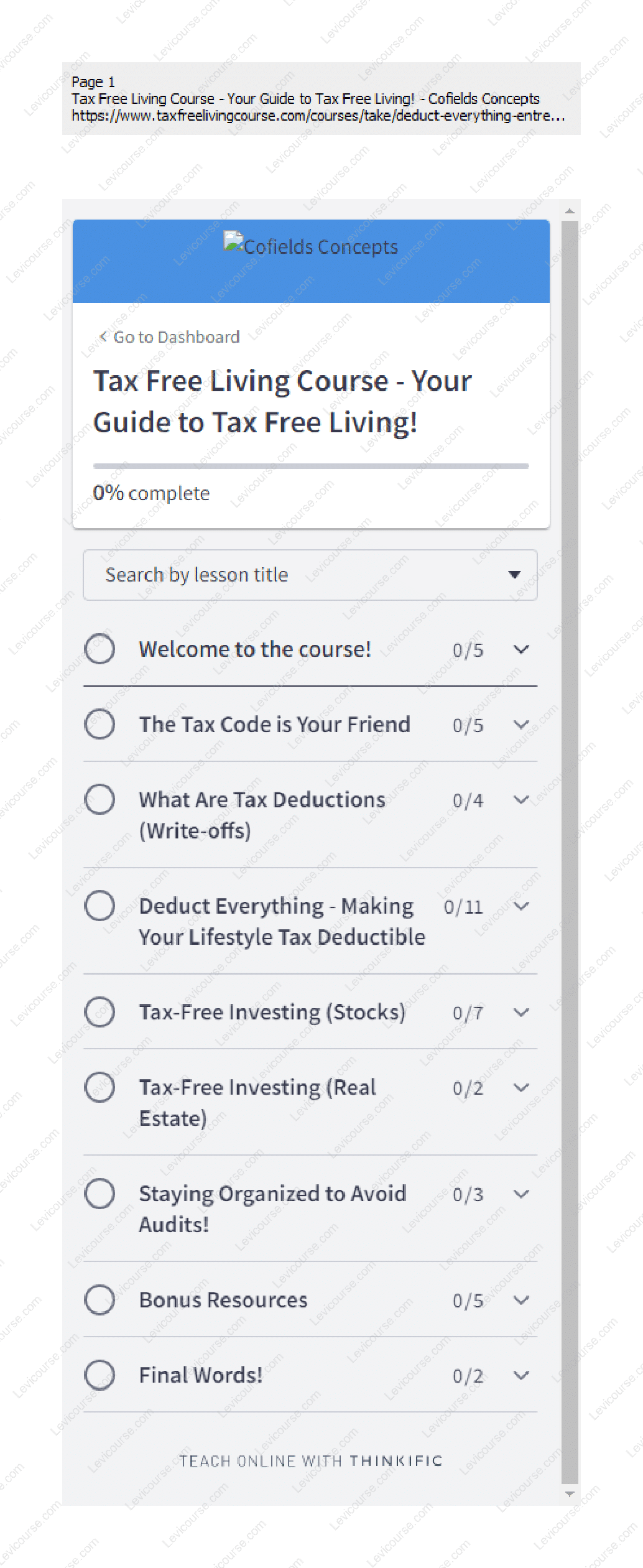

This in-depth program consists of nine modules that simplify the complexities of the tax code into actionable, everyday strategies you can use to save thousands of dollars each year.

Module 1 – Welcome to the Course

-

Meet your instructor, Carter Cofield, and learn how to navigate the course.

-

Understand how to apply the concepts responsibly with the included disclaimer and resources.

-

Access your “Deduct Everything” PowerPoint slides for a visual roadmap.

Module 2 – The Tax Code Is Your Friend

-

Learn how the tax code is designed to reward entrepreneurs, investors, and job creators.

-

Understand the difference between employees and entrepreneurs—and why one pays more in taxes.

-

Apply Carter’s “Golden Formula” to position yourself for tax savings.

-

Bonus: Access the Side Gig Cheat Code and optional Side Hustle Bootcamp to turn your hobbies into tax-deductible businesses.

Module 3 – What Are Tax Deductions (Write-Offs)?

-

Discover exactly what qualifies as a tax deduction.

-

Learn which personal and business expenses can reduce your taxable income.

-

Explore the most common deductions every entrepreneur must know.

Module 4 – Deduct Everything: Making Your Lifestyle Tax-Deductible

-

Transform personal spending into business deductions legally and ethically.

-

Learn 10 creative ways to make your everyday lifestyle tax-deductible.

-

Walk through the Ultimate Tax Deduction Calculator to estimate your savings.

-

Discover strategies for tax-free travel, vehicles, and family payroll:

-

Write off your G-Wagon or Tesla.

-

Pay your children tax-free.

-

Deduct designer purchases like Cartier frames.

-

-

Access the Tax-Free Living E-Book with 200+ deductions and examples.

-

Learn how to find a business purpose for almost everything you own.

Module 5 – Tax-Free Investing (Stocks & Crypto)

-

Understand capital gains taxes and how to minimize them.

-

Apply tax-loss harvesting to offset profits with strategic losses.

-

Explore tax-advantaged accounts like IRAs and Solo 401(k)s.

-

Learn how to invest in cryptocurrency tax-free using self-directed accounts.

-

Access the Taxes for Traders Cheat Sheet for fast reference.

Module 6 – Tax-Free Investing (Real Estate)

-

Learn why real estate is one of the most powerful tax shelters.

-

Understand how depreciation creates “cash flow now, paper loss later.”

-

Discover the 1031 Exchange strategy to grow wealth without triggering taxes.

-

Apply these techniques to compound property-based earnings over time.

Module 7 – Staying Organized to Avoid Audits

-

Learn bookkeeping best practices to stay compliant and audit-ready.

-

Get a full QuickBooks Masterclass for tracking expenses and receipts.

-

Identify IRS red flags and learn 10 expert tips to minimize audit risk.

Module 8 – Bonus Resources & Mentorship

-

Join the Tax-Free Living Facebook Community for ongoing discussion.

-

Participate in monthly mentorship calls with Carter and guest experts.

-

Access exclusive webinars, workshops, and interviews on advanced tax strategies.

-

Download the Tax-Free Living E-Book (200+ deductions) and other tools to reinforce your learning.

Module 9 – Final Words

-

Review key takeaways and next steps to start implementing your new knowledge.

-

Get inspired by Carter’s final message on building a tax-free, financially free lifestyle.

Core Features and Benefits

-

9 In-Depth Modules: Covering everything from tax deductions to investing and organization.

-

500+ Legal Deductions Explained: Through checklists, eBooks, and examples.

-

Real-World Examples: How to deduct travel, vehicles, and business expenses ethically.

-

Investment Training: Learn tax-free investing in both the stock market and real estate.

-

Audit-Proof Systems: Build clean financial records that withstand scrutiny.

-

Lifetime Access: Revisit lessons anytime as tax laws and your business evolve.

-

Community Mentorship: Stay supported through ongoing Q&A sessions and Facebook access.

This course gives you not just knowledge—but the confidence and systems to manage your taxes like a pro.

Who This Course Is For

The Tax-Free Living Course by Carter Cofield is perfect for:

-

Entrepreneurs, freelancers, and small business owners ready to maximize deductions.

-

Investors in real estate, stocks, or crypto looking for smarter tax strategies.

-

Side hustlers who want to turn their gig into a legitimate tax-saving business.

-

High-income professionals seeking to keep more of what they earn.

-

Anyone interested in financial freedom and wealth creation through intelligent tax planning.

If you’ve ever felt like taxes hold you back from financial independence, this course will show you how to change that—legally and effectively.

About the Instructor – Carter Cofield

Carter Cofield, CPA, is a financial educator, tax strategist, and the founder of Cofield Advisors, a Chicago-based accounting firm dedicated to helping entrepreneurs live financially free.

As a Certified Public Accountant with years of experience advising small business owners and investors, Carter specializes in simplifying complex tax laws and turning them into actionable wealth-building tools.

Through his Tax-Free Living platform, podcasts, and workshops, Carter has helped thousands of people learn how to use the tax code to their advantage, legally reduce liability, and achieve financial freedom.

Final Thoughts – Live Smarter, Wealthier, and Tax-Free

The Tax-Free Living Course – Your Blueprint to Tax-Free Living is more than a tax class—it’s a lifestyle transformation.

By learning to view the tax code as your friend, you’ll unlock opportunities to save money, invest intelligently, and build generational wealth.

👉 If you’re ready to take control of your finances and learn the proven strategies that wealthy individuals use every day—this course is your path to true financial freedom.

Reviews

There are no reviews yet.