Free Download Monetary Mechanics Course 2024 By The Macro Compass – Includes Verified Content:

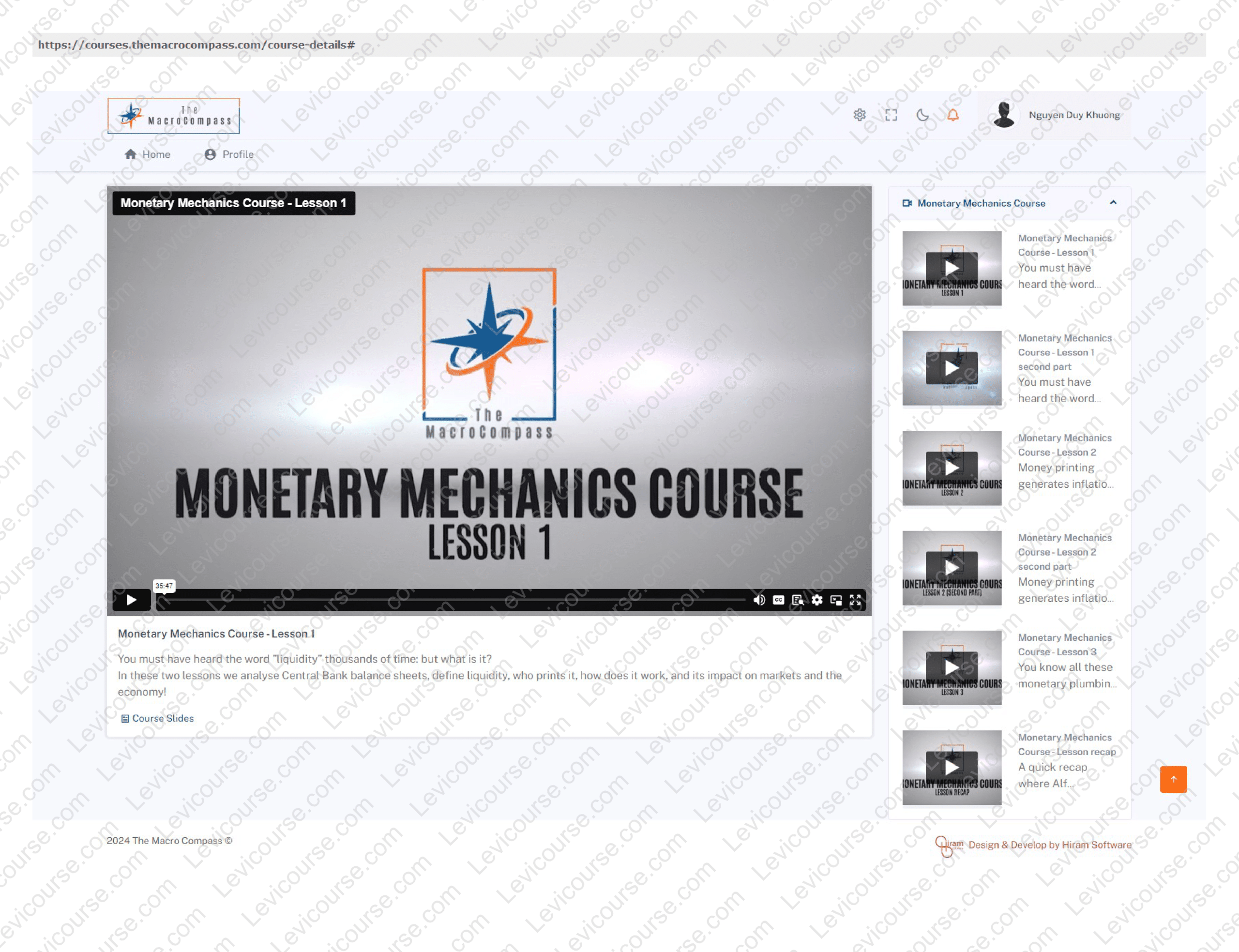

Monetary Mechanics Course 2024 By The Macro Compass – You Can View This Slide PDF Sample for Free to Catch A Glimpse of The Content Inside:

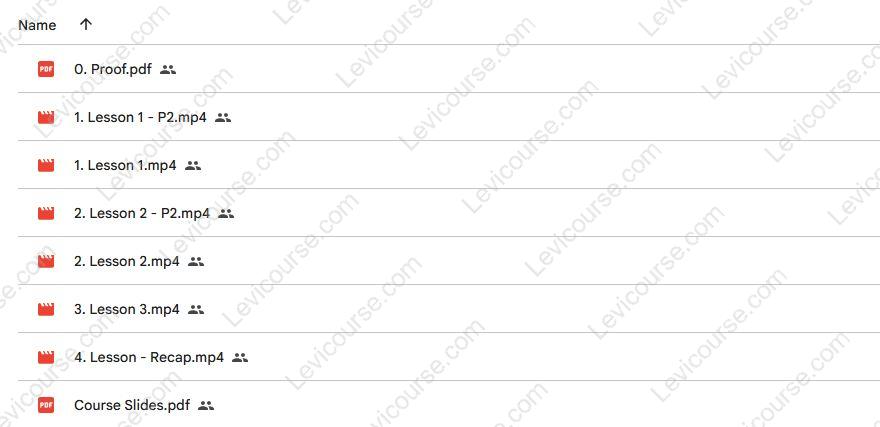

You Can Also Check The Content Proof Here to Know More Information:

Monetary Mechanics Course 2024 By The Macro Compass – Master Monetary Plumbing for Macro Investing

The Monetary Mechanics Course 2024 by The Macro Compass is designed to give macro investors an edge in one of the most critical areas for the next decade: understanding monetary mechanics. Led by Alf, a seasoned institutional investor, this program breaks down fiscal deficits, QE, QT, the Treasury General Account, Reverse Repo, and other monetary plumbing operations into simple, step-by-step explanations.

If you’ve ever struggled to grasp how “liquidity” moves through markets or how central bank operations truly affect the economy, this course delivers the clarity you need.

Why This Course Is Different

Most macro content glosses over the details of how money actually works in practice. This course stands out by:

-

Simplifying Complexity: Alf explains complicated concepts like Reverse Repo and TGA in straightforward, easy-to-grasp language.

-

Real-World Perspective: Learn from a former institutional investor with years of experience navigating central bank policy and market reactions.

-

Focused on Practical Impact: Instead of theory alone, every lesson highlights how monetary mechanics influence markets and investor decisions.

It’s not just about learning definitions—it’s about mastering the flow of money so you can trade and invest with confidence.

What’s Inside the Monetary Mechanics Course

Lesson 1: “Liquidity,” The First Tier of Money

-

Understand what liquidity truly is.

-

Analyze central bank balance sheets.

-

Discover who prints liquidity, how it works, and its impact on markets and economies.

Lesson 2: “Real-Economy Money,” The Second Tier of Money

-

Explore how money printing translates into real-economy inflation.

-

Identify who prints inflationary money, how it happens, and its consequences.

-

Assess the market impact of different forms of real-economy money creation.

Lesson 3: “Monetary Plumbing”

-

Deep dive into operations like Reverse Repo, Treasury General Account, and Bank Term Funding Program.

-

Gain clarity on mechanics that often confuse even seasoned market participants.

Course Recap

-

A summary session highlighting the key lessons from the program, reinforcing your understanding of monetary mechanics.

What You’ll Learn

By completing the Monetary Mechanics Course 2024, you will:

-

Gain a working knowledge of central bank balance sheets.

-

Understand the mechanics of liquidity and its role in markets.

-

Learn the difference between central bank liquidity and real-economy money.

-

Identify how fiscal and monetary operations influence inflation and asset prices.

-

Decode the role of tools like Reverse Repo, TGA, and the Bank Term Funding Program.

-

Build the ability to anticipate how policy changes ripple through the economy and markets.

Core Features / Benefits

-

Structured Learning Path: Each lesson builds on the previous one for a complete understanding.

-

Step-by-Step Explanations: Complex topics are broken down into digestible parts.

-

Practical Market Impact: Always tied back to how monetary operations affect asset prices and investor opportunities.

-

Recap Session: Reinforces the most important takeaways to solidify your knowledge.

-

Future-Proof Skillset: Monetary mechanics will be critical for investors navigating the next decade.

Who This Is For

This course is ideal for:

-

Macro Investors seeking to deepen their edge by mastering monetary plumbing.

-

Traders and Analysts who need to connect policy decisions with market moves.

-

Students of Economics or Finance looking for clarity beyond academic theory.

-

Curious Learners who want to understand how money really works in today’s global system.

About The Instructor – Alf

Alf, founder of The Macro Compass, brings years of institutional investing experience to this program. Having worked through volatile market cycles and directly navigated central bank policy impacts, he is uniquely positioned to translate complexity into actionable insights. His mission is to empower macro investors with the tools and frameworks they need to succeed.

Final Thoughts

The Monetary Mechanics Course 2024 By The Macro Compass is your roadmap to understanding the monetary plumbing system that underpins markets. Whether it’s liquidity, real-economy money, or the intricate world of central bank operations, this program ensures you’ll never be left scratching your head again.

👉 If you’re ready to elevate your macro investing skills, this course offers the clarity, depth, and real-world application you need.

Reviews

There are no reviews yet.