Free Download LLC to S Corp Conversion Kit 2025 by William Bronchick – Includes Verified Content:

LLC to S Corp Conversion Kit 2025 – All About This Complete Legal And Tax-Saving Toolkit With William Bronchick

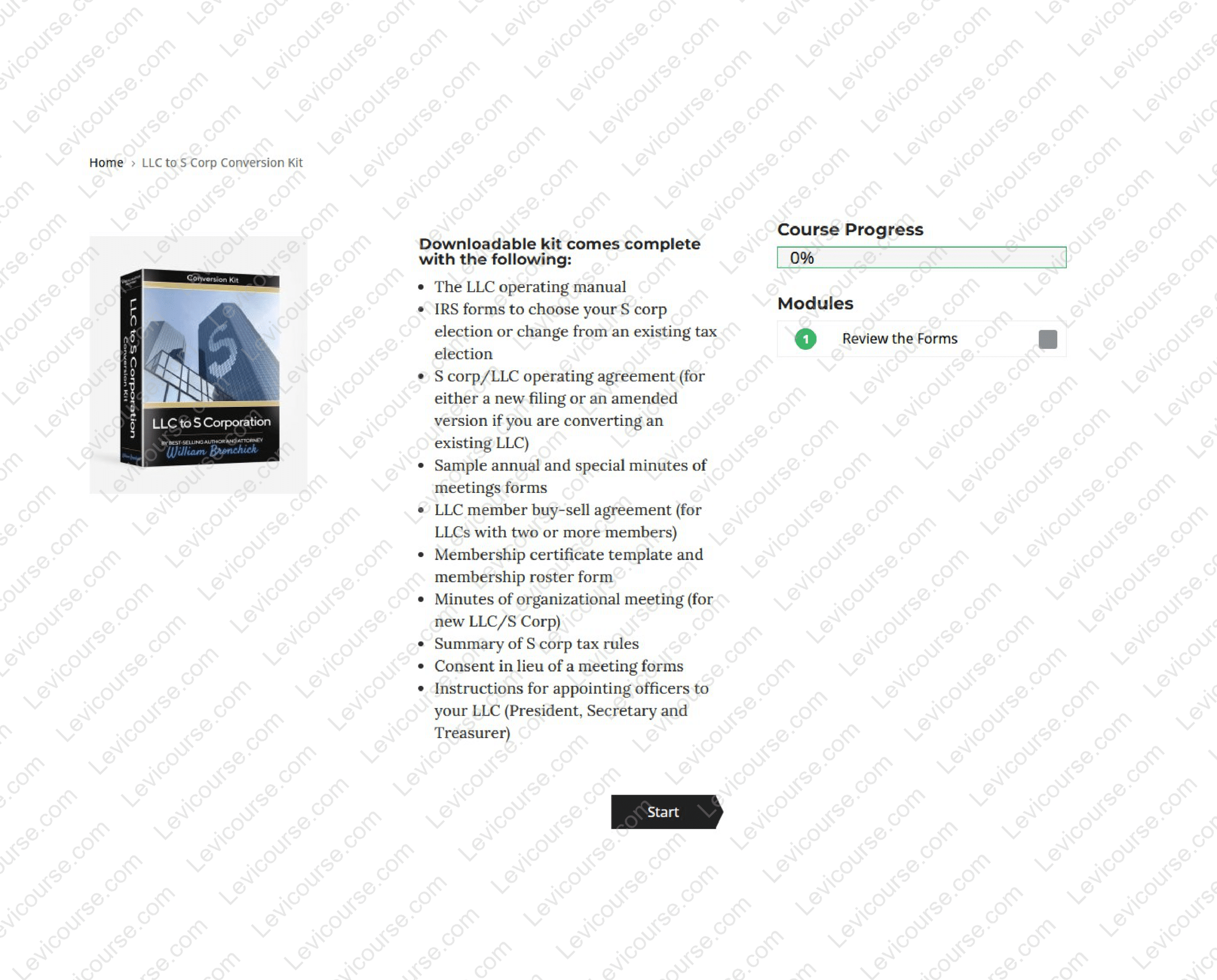

You Can Watch This PDF Sample for Free to Catch A Glimpse of The Content Inside:

LLC to S Corp Conversion Kit 2025 – You Can Also View The Details below to Know More Information:

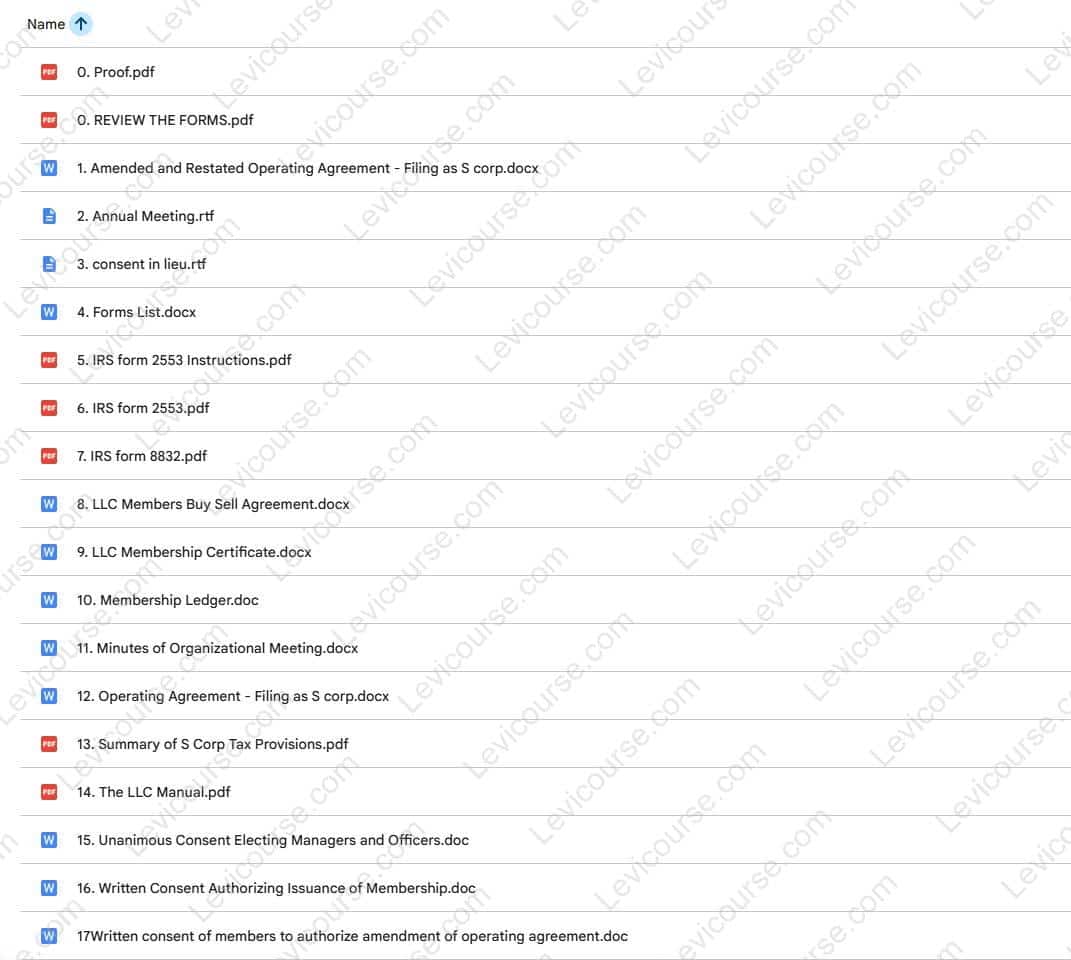

And Finally, You Can Check The Content Proof Here:

LLC to S Corp Conversion Kit 2025 by William Bronchick – Slash Taxes and Keep Your LLC Simplicity

LLC to S Corp Conversion Kit 2025 by William Bronchick is a complete legal and tax solution for single-member LLC owners who want to reduce their self-employment taxes by converting to an S Corporation — without changing their company name, EIN, or structure. Created by Attorney and Investor William Bronchick, ESQ., this kit includes every IRS form, agreement, and step-by-step instruction you need to save thousands of dollars per year while staying compliant.

About the Course / Kit

If you own a single-member LLC, you may be paying way too much in taxes — simply because of how you set it up.

By default, most single-member LLCs are taxed as “disregarded entities,” meaning all income flows to your personal return on Schedule C. While that’s simple, it also means you’re paying full self-employment tax (Social Security, Medicare, etc.) on your profits. That’s thousands of dollars a year — gone.

The solution?

Convert your existing LLC into an S Corporation for tax purposes — and keep all the same benefits of your LLC structure.

Attorney William Bronchick has created a one-of-a-kind resource that makes this conversion easy, legal, and foolproof.

“You can keep your LLC name, bank account, and EIN… but for tax purposes, become an S Corp and save thousands every year.”

— William Bronchick, ESQ.

Why Convert from LLC to S Corporation

The difference between an LLC and an S Corp isn’t in liability — it’s in how you’re taxed.

Here’s the problem with a standard single-member LLC:

-

All income is taxed as earned income on your personal return.

-

You pay self-employment tax (15.3%) on top of regular income tax.

-

The more you earn, the higher your tax burden grows.

Here’s what happens when you convert to an S Corporation:

✅ You pay yourself a reasonable salary (subject to payroll taxes).

✅ The rest of your profits are distributions — not subject to self-employment tax.

✅ You can potentially cut your tax bill by thousands of dollars each year.

Example:

If your business nets $100,000 and you take $50,000 as salary and $50,000 as distributions, you’ll save around $7,500–$10,000 annually in self-employment taxes.

That’s real money — year after year.

Attention Real Estate Investors

If you’re a flipper or wholesaler, the IRS may classify you as a dealer, which means your income is “active,” not passive.

That means:

-

Your profits are reported on Schedule C.

-

You’ll owe self-employment tax plus federal and state income tax.

Over three years of flipping with $100,000 annual profit, that could mean an IRS bill of tens of thousands in back taxes and penalties.

Converting your LLC to an S Corporation can protect your income and keep your business compliant.

“Flippers, wholesalers, and short-term rental owners (Airbnb/VRBO) are especially vulnerable — an S Corp could save your business from a tax nightmare.”

— William Bronchick, ESQ.

Why This Kit Is a Game-Changer

You don’t need to dissolve your LLC, start over, or hire an expensive CPA or attorney.

With Bronchick’s LLC to S Corp Conversion Kit 2025, you can:

✅ Keep your existing LLC name, EIN, and bank accounts.

✅ Continue using your same contracts and licenses.

✅ File a few simple IRS forms and update your operating agreement.

✅ Be treated as an S Corporation for tax purposes — instantly reducing your liability.

It’s the easiest, fastest, and most affordable way to upgrade your business structure and lower your tax bill.

What’s Inside the LLC to S Corp Conversion Kit 2025

📘 The LLC Operating Manual

Step-by-step instructions on:

-

How LLCs and S Corps differ in taxation.

-

How to make your election with the IRS.

-

How to manage your company post-conversion.

Covers everything from entity management to officer duties.

📄 IRS Forms and Filing Instructions

Includes all required IRS paperwork:

-

Form 2553: Election by a Small Business Corporation.

-

Form 8832: Entity Classification Election (if needed).

-

Sample filing letters and checklists for each form.

-

Instructions for both new LLCs and existing LLC conversions.

You’ll file these once and start saving immediately.

📑 S Corp / LLC Operating Agreement

A dual-purpose agreement you can use for:

-

A brand new LLC electing S Corp status, or

-

An existing LLC converting from “disregarded” to S Corp taxation.

Includes clauses for officer roles, profit distributions, payroll, and member responsibilities.

📚 Sample Corporate Documents

Professionally drafted templates, including:

-

Minutes of Organizational Meeting (for new S Corp elections).

-

Annual & Special Meeting Minutes.

-

Consent in Lieu of Meeting forms.

-

Appointment of Officers (President, Secretary, Treasurer).

-

Buy-Sell Agreement for multi-member LLCs.

-

Membership Certificates & Roster Form.

All editable and formatted for MS Word — ready to customize and print.

📘 Tax Rules Summary & Compliance Guide

Understand how S Corp taxation works:

-

How to calculate a “reasonable salary.”

-

How to handle payroll tax filings.

-

How to record distributions properly.

-

Common IRS mistakes and how to avoid them.

This guide alone could save you from an audit.

🧾 Membership Certificate & Buy-Sell Agreement

For multi-member LLCs electing S Corp status, includes:

-

Ownership structure templates.

-

Capital contribution tracking.

-

Rules for member exits and buyouts.

Ensures your ownership documentation remains legally bulletproof.

Who Should Use This Kit

-

Small business owners running LLCs with active income.

-

Real estate wholesalers and flippers who need to reduce tax exposure.

-

Short-term rental operators (Airbnb/VRBO) generating active income.

-

Consultants, freelancers, and service providers earning $50K+ annually.

-

Partnership LLCs looking to simplify tax filing and protect earnings.

If your LLC earns active income, you’re likely paying more taxes than you need to.

Key Benefits

After implementing LLC to S Corp Conversion Kit 2025, you will:

✅ Cut your self-employment tax bill by thousands per year.

✅ Maintain the simplicity and flexibility of your LLC.

✅ Keep your same name, EIN, and accounts.

✅ Operate legally and confidently under IRS rules.

✅ Have every document and form you need to complete your conversion in hours — not weeks.

You’ll enjoy more income, less stress, and full IRS compliance.

Why Learn from William Bronchick

William Bronchick, ESQ. is a leading attorney, author, and real estate educator with over 30 years of experience helping entrepreneurs structure and protect their businesses.

-

Featured in Bloomberg, CNBC, TIME, and Wall Street Journal.

-

Founder of the Colorado Association of Real Estate Investors.

-

Author of Financing Secrets of a Millionaire Real Estate Investor.

-

Trusted legal advisor to thousands of business owners and investors.

Bronchick’s practical, step-by-step kits are known nationwide for being accurate, affordable, and easy to implement.

Final Thoughts – Keep Your LLC, Lower Your Taxes

You don’t have to start over or pay an expensive CPA to stop overpaying the IRS.

With LLC to S Corp Conversion Kit 2025 by William Bronchick, you’ll have everything you need to make the switch legally, confidently, and quickly — and start saving money this year.

👉 Download the kit today and discover how easy it is to keep your LLC’s flexibility while enjoying S Corp-level tax savings.

Reviews

There are no reviews yet.