Free Download IRA Investing Course 2025 by William Bronchick – Includes Verified Content:

All About This Step-By-Step Online Course By Attorney And Real Estate Expert William Bronchick Revealing How To Use Self-Directed IRAs And 401(k)s To Invest In Real Estate And Other High-Yield Assets—Completely Tax-Free

IRA Investing Course 2025 by William Bronchick – You Can Listen To This Audio Sample for Free to Know More Information:

IRA Investing Course 2025 by William Bronchick – You Can Also View The PDF Sample below to Catch A Glimpse of The Content Inside:

IRA Investing Course 2025 by William Bronchick – And Finally, You Can Check The Content Proof Here:

IRA Investing Course 2025 by William Bronchick – Build Wealth & Retire Tax-Free Through Real Estate

IRA Investing Course 2025 by William Bronchick teaches you how to supercharge your retirement savings by investing in real estate and alternative assets through a self-directed IRA or 401(k)—tax-deferred or even tax-free. Learn directly from William Bronchick, ESQ., attorney, investor, and author, how to legally grow your retirement fund from a few thousand dollars to millions with creative, compliant investing strategies.

About the Course

If you’re tired of watching your IRA lose value in mutual funds and stocks, it’s time to take control.

IRA Investing Course 2025 by William Bronchick, ESQ. reveals how to legally direct your retirement money into high-yield real estate deals and non-traditional investments—without paying penalties or taxes.

You’ll learn the same strategies top investors use to turn small retirement accounts into six- and seven-figure portfolios by compounding returns and keeping the IRS out of your pocket.

“It’s not what you contribute to your IRA—it’s the rate of return you earn that determines your wealth.”

— William Bronchick, ESQ.

Why This Course Matters

Most Americans retire broke—living on $23,000 a year or less. Social Security won’t save you, and traditional 401(k)s and IRAs barely beat inflation.

But with a self-directed IRA, you can:

✅ Invest in real estate, notes, tax liens, and private lending.

✅ Earn double-digit returns—tax-deferred or tax-free.

✅ Take control of your money instead of letting Wall Street gamble with it.

✅ Build a retirement fund that actually supports your lifestyle.

When you control your investments, you control your future.

About the Instructor – William Bronchick, ESQ.

William Bronchick is a best-selling author, attorney, and real estate investor with over 30 years of experience helping Americans grow and protect their wealth.

-

Author of Financing Secrets of a Millionaire Real Estate Investor and Flipping Properties.

-

Featured in TIME, CNBC, Bloomberg, Wall Street Journal, and Money Magazine.

-

Founder of the Colorado Association of Real Estate Investors (CAREN).

-

Expert on IRS rules, self-directed retirement accounts, and creative real estate investing.

Bronchick’s expertise ensures you not only maximize profits but do so 100% legally and ethically.

It’s the Return, Stupid!

You don’t need to contribute thousands each year to grow your IRA—you just need better returns.

Example:

-

$5,000 per year earning 12% = ~$750,000 in 25 years.

-

$5,000 per year earning 20% = ~$3.5 million in 25 years.

The difference? The right investment strategy. Real estate delivers the leverage and returns traditional accounts never will.

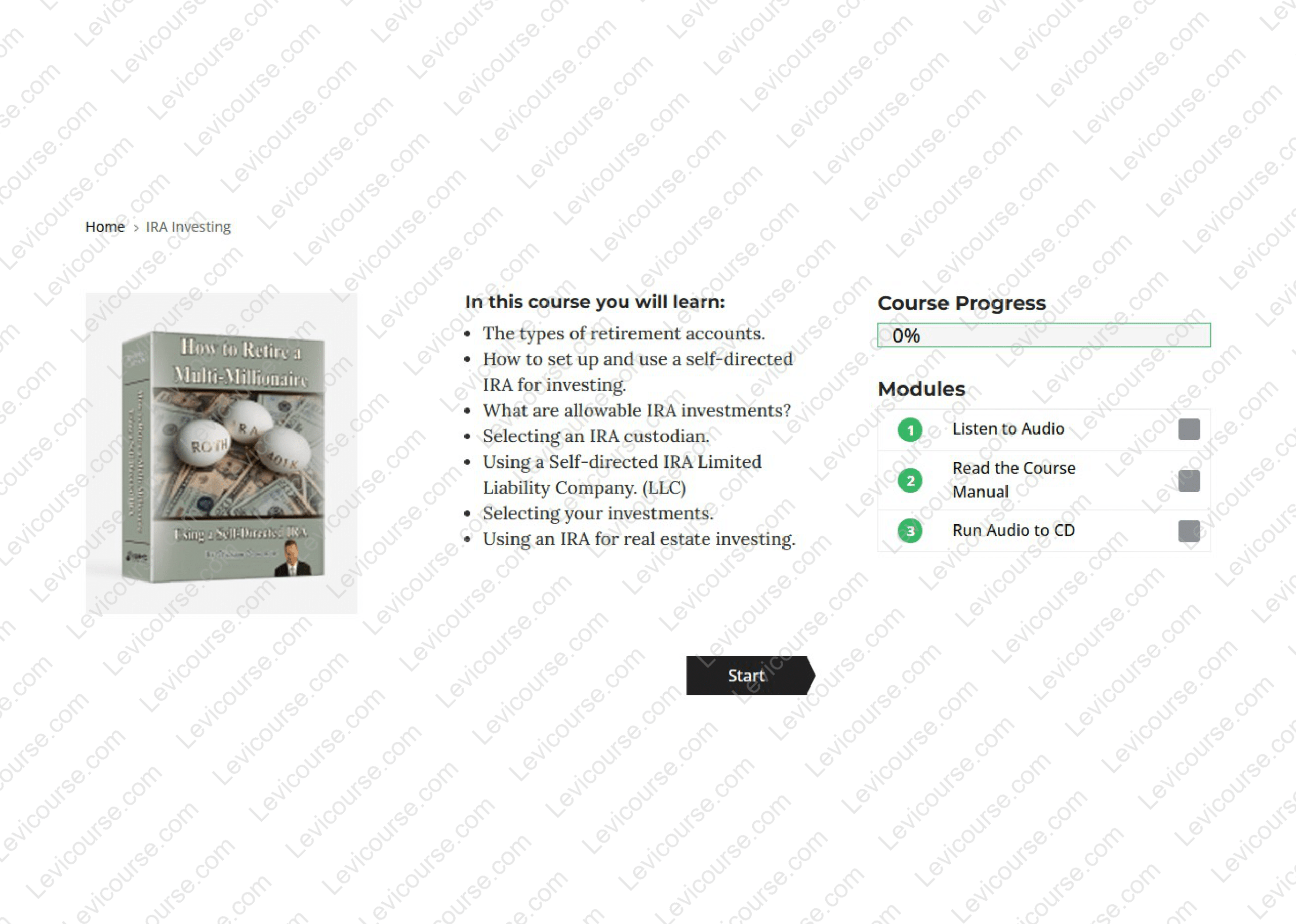

What You’ll Learn

This powerful online training teaches you everything you need to know to legally grow your IRA or 401(k) with high-yield investments.

1️⃣ How to Open and Run a Self-Directed IRA

-

Step-by-step guide to establishing your self-directed IRA or Solo 401(k).

-

Which custodians and administrators are the best for investors.

-

How to roll over existing accounts without triggering taxes or penalties.

-

How to structure your account for maximum flexibility and control.

2️⃣ How to Invest in Real Estate Using Your IRA

Learn creative, compliant methods to buy properties through your IRA.

You’ll discover:

-

How to use IRA funds for wholesaling, flipping, rentals, and notes.

-

How to partner your IRA with others (or even with yourself) legally.

-

The difference between tax-deferred and tax-free (Roth) investments.

-

Case studies showing real investors making six figures through IRA deals.

3️⃣ How to Legally Borrow and Leverage Your IRA

-

How to use non-recourse loans to leverage your IRA for bigger deals.

-

How to safely invest alongside “disqualified parties.”

-

How to borrow from your IRA (and pay yourself back—with interest).

-

How to legally generate spendable cash flow from your retirement investments.

Leverage accelerates your returns—and Bronchick shows you how to use it legally.

4️⃣ Checkbook Control for Maximum Freedom

-

How to establish an LLC-owned IRA (IRA/LLC) for checkbook control.

-

How to write checks directly for deals—no waiting on custodians.

-

Rules for recordkeeping and compliance.

-

The “do’s and don’ts” of managing your own account safely.

This gives you total control over where and when you invest.

5️⃣ Qualified vs. Disqualified Transactions

Avoid costly mistakes that could disqualify your IRA.

You’ll learn:

-

Who counts as a “disqualified person” under IRS rules.

-

What types of transactions are allowed—and which are not.

-

How to structure deals that pass IRS scrutiny.

-

The penalties for prohibited transactions (and how to avoid them).

Bronchick’s legal experience ensures you stay 100% compliant.

6️⃣ Creative Investment Strategies for IRA Growth

Expand your IRA beyond Wall Street. You’ll learn how to:

-

Invest in private loans, partnerships, tax liens, and subject-to deals.

-

Earn tax-free rental income and capital gains inside your IRA.

-

Turn small investments into big paydays through creative deal structuring.

-

Multiply returns by combining IRA funds with other investors.

These proven methods create exponential growth without additional contributions.

What’s Included

📘 Downloadable Course Manual

A detailed training guide covering:

-

Step-by-step IRA setup instructions.

-

Real-world case studies and examples.

-

Sample deal structures, compliance checklists, and IRA forms.

🎧 Four Audio Training Sessions

Professionally recorded from Bronchick’s live seminar, including Q&A sessions.

Learn on the go—download MP3s to your phone, tablet, or car.

💻 Video Lessons

High-definition video modules explaining complex rules and real examples in simple, practical language.

📂 Legal & Financial Resources

Includes sample IRA/LLC documents, custodian contact lists, and compliance resources you can use immediately.

Key Benefits

After completing IRA Investing Course 2025, you will:

✅ Know how to open and operate a self-directed IRA or Solo 401(k).

✅ Legally invest in real estate and other high-return assets.

✅ Avoid all prohibited transaction pitfalls.

✅ Gain checkbook control of your IRA funds.

✅ Multiply your retirement savings tax-deferred or tax-free.

✅ Build a retirement you control — not one dictated by Wall Street.

Even one successful IRA deal could earn you more than years of traditional investing.

Who This Course Is For

-

Real estate investors who want to grow tax-free wealth.

-

Retirees seeking more control over their accounts.

-

Professionals frustrated with market volatility.

-

New investors who want to turn small contributions into big returns.

If you’re ready to grow your retirement fund the smart, legal, and profitable way, this course is for you.

Why This Course Works

Unlike most IRA “gurus,” William Bronchick is both a practicing attorney and an investor. His methods are 100% compliant, tested, and easy to implement.

You’ll get real legal insight and practical, actionable instruction—not just theory or hype.

This training turns complex IRS rules into a clear roadmap for wealth building.

“The sooner you control your IRA, the sooner you control your future.”

— William Bronchick, ESQ.

Final Thoughts – Take Control of Your Retirement

Stop hoping your 401(k) will magically recover. Take charge of your future with IRA Investing Course 2025 by William Bronchick.

Learn how to invest in real estate and other alternative assets tax-free, legally, and profitably. You’ll gain the tools, confidence, and knowledge to grow your retirement funds faster than you ever thought possible.

👉 Enroll now and start building a self-directed, tax-free real estate portfolio that funds the retirement you deserve.

Reviews

There are no reviews yet.