Build Flexible NinjaTrader 8 Strategy Architecture — Learn Yuri Zolotarev’s Complete Framework For Coding Robust Trade Systems Using Unmanaged Orders

Digital Download Trade System Architecture by Ninja Coding – Includes Useful Content:

Trade System Architecture by Ninja Coding – You Can Watch This Video Sample for Free to Know More Information:

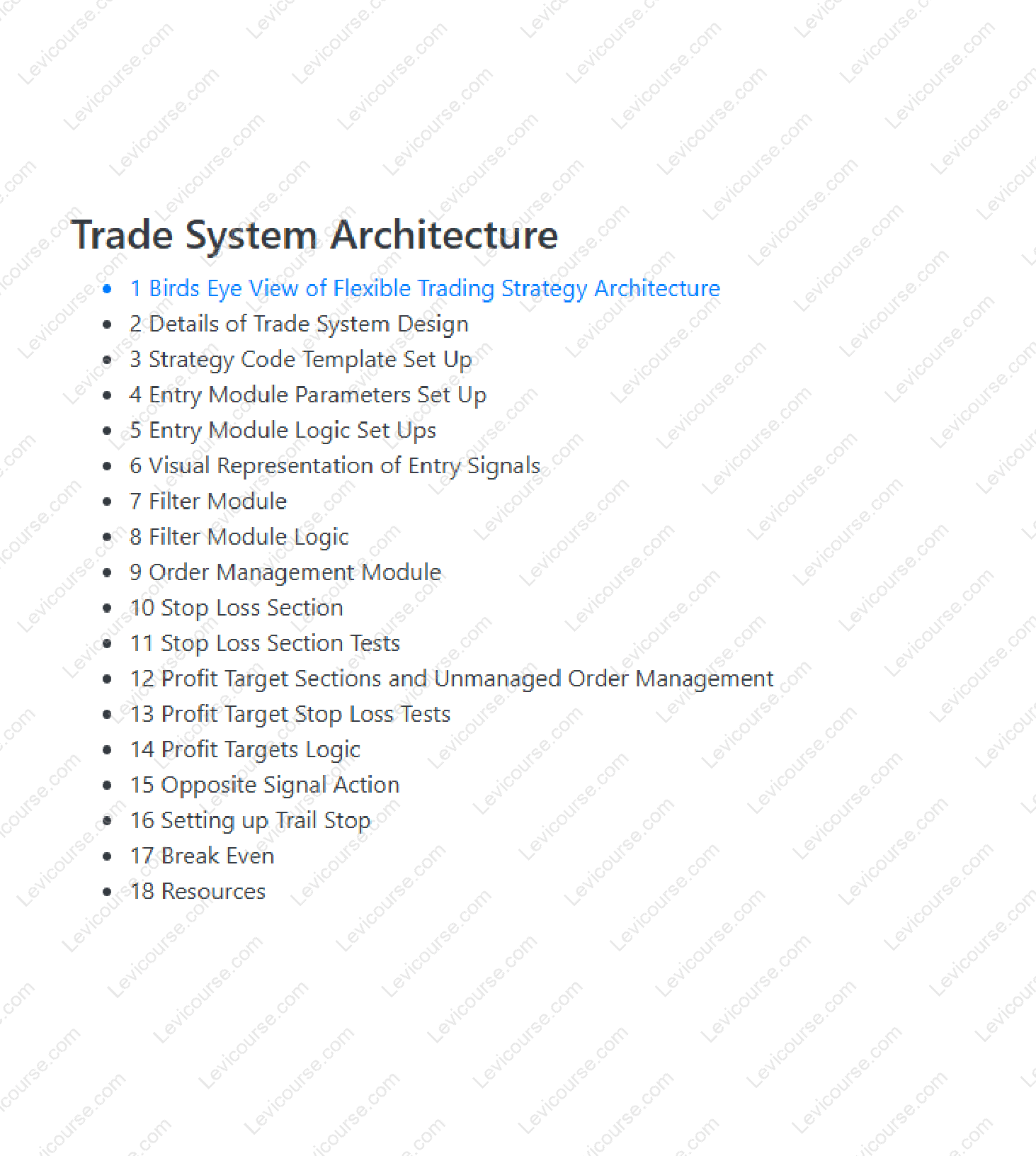

Trade System Architecture by Ninja Coding – You Can Also Check The Content Proo below to Catch A Glimpse of The Content Inside:

Trade System Architecture by Ninja Coding – Build Flexible & Scalable Trade System Architecture for NinjaTrader 8

Trade System Architecture by Ninja Coding (Yuri Zolotarev) is a 4-hour masterclass revealing the core architecture, coding patterns, and system structures behind professional-grade automated trading strategies in NinjaTrader 8. Learn trails, stops, unmanaged orders, breakevens, reversals, partial exits, splits, filters, and the flexible infrastructure needed to rapidly build, test, and deploy algorithmic ideas with confidence.

About the Program

A Masterclass Built on 5 Years of Real-World Coding Experience

If you’ve ever tried to build a complete automated trading system in NinjaTrader 8, you already know the truth:

Entry signals are the easy part. Robust architecture is the hard part.

Order management… partial exits… break-even logic… advanced trail rules… combining filters… eliminating hidden NinjaTrader bugs… making systems flexible instead of fragile — this is where traders get stuck.

That’s why Yuri Zolotarev spent five years developing and refining the most flexible, reusable trade system architecture possible — and has distilled the entire framework into 18 powerful lessons totaling 4 hours of high-value content.

If you want a trading system structure you can extend, modify, and test within minutes — instead of rewriting spaghetti code for every idea — this is the course built for you.

What You’ll Learn Inside Trade System Architecture

✓ Master Unmanaged Orders in NinjaTrader 8

Before you can build advanced exits or dynamic stops, you must understand how unmanaged orders work. Yuri breaks down the exact workflow, event handling, and architecture behind professional unmanaged systems.

✓ Code Trails, Break-Evens & Stop Losses Correctly

Learn how to implement the most commonly used risk-management tools, including:

-

Dynamic trail stops

-

Logic-driven breakeven triggers

-

Static and conditional stop losses

-

Stop optimization and debugging

These are the tools behind stable, scalable systems — not rigid one-off scripts.

✓ Build Position Splits & Attach Logic to Split Events

Splitting trades for scaling in/out is tricky in NinjaTrader — unless you know the underlying mechanics. You’ll learn:

-

How to code position splits

-

How to attach logic to each split event

-

How to manage exits for individual scaled segments

This gives you hedge-fund-level control over position micro-management.

✓ Avoid Hidden NinjaTrader 8 Errors & Pitfalls

Yuri exposes the “undercover errors” that cost him countless nights of debugging frustration — and teaches you how to identify, prevent, and fix them instantly. These insights alone can save you hundreds of wasted hours.

✓ Reverse Positions & Combine Entry Signals Seamlessly

You’ll learn:

-

How to reverse positions properly

-

How to avoid double-execution bugs

-

How to combine multiple signals into one master entry module

-

How to apply global optional filters

This is the foundation of a plug-and-play architecture where ideas can be swapped, tested, and optimized effortlessly.

✓ Build a Fully Flexible Trading Strategy Infrastructure

The core purpose of this program is simple:

To give you a reusable code framework where adding a new signal or exit rule takes minutes — not days.

You’ll learn Yuri’s exact structure for:

-

Entry module

-

Filter module

-

Order management module

-

Stop loss section

-

Profit target logic

-

Trail logic

-

Break-even logic

-

Opposite signal handling

-

Partial exits and splits

This creates a backbone you can adapt for nearly any system idea.

Why This Course Is a Game-Changer

Built for Traders Who Want Architecture—not just signals

Most NinjaTrader tutorials teach:

❌ “Here is an entry signal.”

❌ “Here is a simple stop.”

❌ “Here is a basic target.”

But real strategies require architecture — not random fragments.

This course gives you the exact reusable system structure that 90% of professional strategies rely on, including:

-

Modular entries

-

Optional filters

-

Shared global logic

-

Scalable order handling

-

Safe and predictable exit logic

-

Systematic trails & reversals

This is the difference between a beginner script and a real strategy you can trust with real capital.

Course Breakdown – 18 Industry-Level Lessons

1. Bird’s Eye View of Flexible Trading Strategy Architecture

Understand the complete system blueprint and the core modules that everything else depends on.

2. Details of Trade System Design

Zooming into the actual structure: how each piece interacts and how logic flows between modules.

3. Strategy Code Template Setup

Start with a well-organized template that keeps your code clean and easy to extend.

4–6. Entry Module Setup, Logic, & Visual Signals

Learn how to build, trigger, combine, and visualize entry conditions.

7–8. Filter Module & Filter Logic

Add optional filters without bloating your main strategy logic.

9. Order Management Module

The backbone of your system — unmanaged orders done right.

10–11. Stop Loss Logic & Testing

Design clean stop loss logic and test it robustly.

12–14. Profit Target Logic, Unmanaged Order Handling & Tests

Everything you need for consistent exits using unmanaged orders.

15. Opposite Signal Action

Handling reversals with confidence and zero bugs.

16–17. Trail Stops & Break-Evens

Advanced techniques for dynamic trade management.

18. Resources & Templates

Supporting materials to help you continue building after the course.

Perfect For:

• Algorithmic traders

who want to accelerate the development of robust automated strategies.

• NinjaTrader 8 users

serious about mastering unmanaged order flow and advanced logic.

• Developers building modular strategy frameworks

that can be extended for years.

• Traders tired of rewriting code for every new idea

and want a reusable system backbone.

• Anyone who wants professional-grade architecture

without spending 5 years figuring it out the hard way.

Final Thoughts – Build Trading Systems That Scale With Your Vision

Whether you’re coding your first automated strategy or refining a portfolio of systems, Trade System Architecture gives you the flexible structure, powerful tools, and battle-tested insights you need to build algorithms that perform reliably — and grow with your trading career.

Stop struggling with messy logic, rigid templates, and NinjaTrader quirks. Build your systems the right way, from day one.

👉 Join now and take the first step toward building scalable, professional-grade trading architecture with NinjaTrader 8.

Reviews

There are no reviews yet.