High-Income Volatility Options Strategy — Learn My Options Edge’s Proven VXX Short Vertical Method For Consistent Weekly Profits

Free Download Stock Options Strategy: VXX Short Vertical (mid/high risk) by My Options Edge – Includes Verified Content:

Stock Options Strategy: VXX Short Vertical (Mid/High Risk) by My Options Edge – You Can Watch This Video Sample for Free to Know More Information:

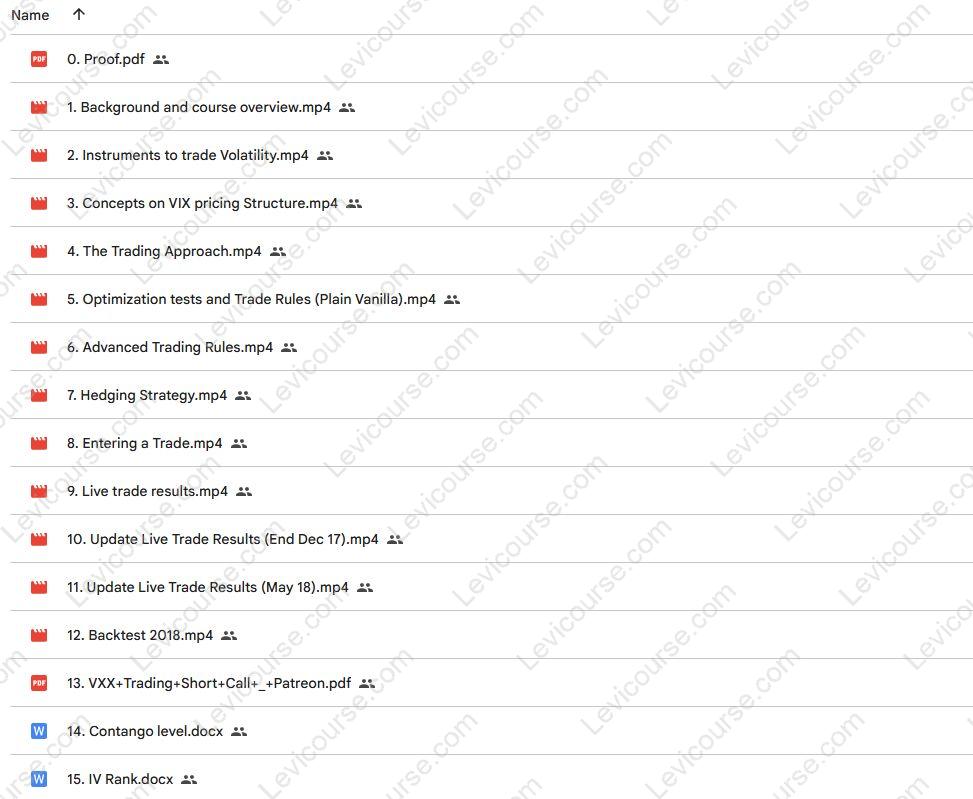

You Can Also View The Screenshot below to Catch A Glimpse of The Content Inside:

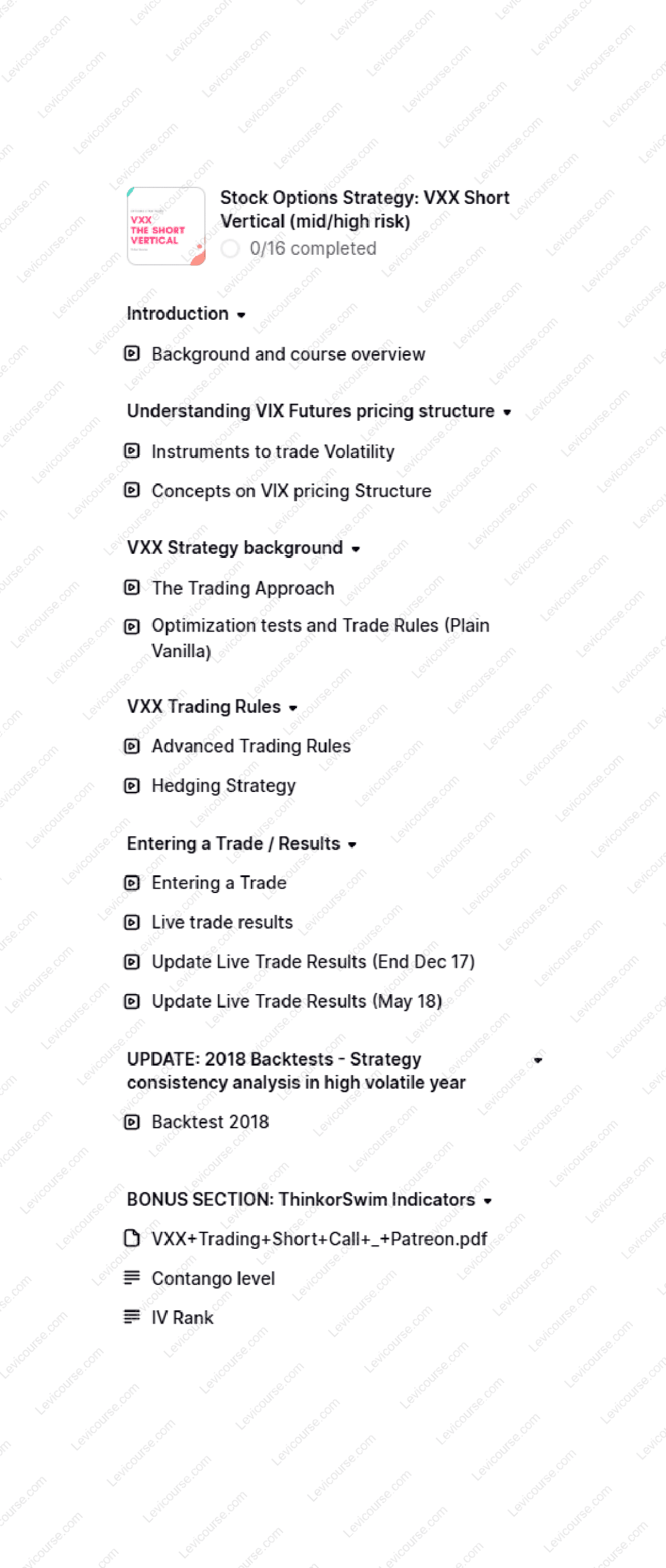

Stock Options Strategy: VXX Short Vertical (Mid/High Risk) by My Options Edge – And Finally, You Can Check The Content Proof Here:

Stock Options Strategy: VXX Short Vertical (Mid/High Risk) by My Options Edge – Weekly Income from Volatility with Controlled Risk

The VXX Short Vertical Strategy by My Options Edge is a high-performing, volatility-based trading system designed to deliver steady weekly income using VXX options. With clear, mechanical rules and built-in hedging protection, this approach leverages the predictable nature of volatility ETNs to generate consistent profits in both calm and volatile markets.

About the Program

The Stock Options Strategy: VXX Short Vertical (Mid/High Risk) is a proven, statistically-backed options strategy developed by a professional volatility trader and tested over years of live trading. This approach capitalizes on the natural decay of VXX while minimizing exposure to large volatility spikes through smart hedging.

Unlike complex, discretionary systems that depend on market timing or subjective analysis, the VXX Short Vertical is a rule-based method that works within defined market conditions — those you’ll learn to identify and exploit for weekly income.

This course provides a step-by-step trading plan backed by historical testing, optimization, and live examples. It’s not theory — it’s a real trading strategy used every week by the instructor in his own portfolio.

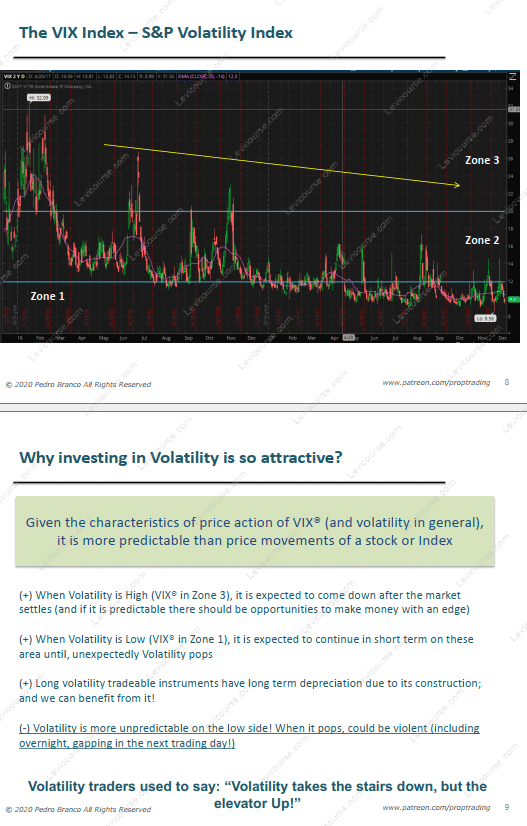

Why Trade Volatility?

Most traders chase direction — trying to predict whether stocks or indices will rise or fall. But volatility products like VXX, which track short-term VIX futures, follow structural behaviors that make them easier to trade systematically.

Because of contango and roll yield, VXX tends to decay in value over time. That means traders can take advantage of this statistical edge through properly constructed options positions. However, sudden volatility spikes can create temporary drawdowns — which is why this system includes a built-in hedging component using VIX options.

This combination of predictable price behavior, systematic rules, and protective hedging makes the VXX Short Vertical Strategy one of the most balanced income-generating methods available to retail traders.

Why the VXX Short Vertical Strategy Works

The secret behind the VXX Short Vertical is simple: it combines Theta-positive income with volatility decay while controlling for market shocks.

Here’s why it stands out:

✅ Statistical Edge:

Backtested results demonstrate consistent long-term profitability, even in turbulent years.

✅ Weekly Income Potential:

Each trade lasts just a few days to a week, allowing you to compound profits quickly.

✅ Built-In Hedge:

An optional VIX options hedge reduces exposure during volatility surges.

✅ No Daily Monitoring:

Because it’s rules-based, you don’t need to watch the markets constantly.

✅ Works in IRA Accounts:

This low-maintenance strategy is suitable for retirement portfolios seeking stable growth.

✅ Complements Other Systems:

Pairs perfectly with the CROC Trade to diversify income across different volatility setups.

Inside the Strategy

The course starts by covering volatility fundamentals — understanding the VIX Index, VXX structure, and how volatility futures pricing impacts ETN performance. You’ll see how contango, backwardation, and roll yield influence the decay pattern that creates predictable profit windows.

Then, you’ll dive into the strategy itself — the VXX Short Vertical, a defined-risk options setup designed to exploit this decay. It’s constructed as a vertical spread with clear entry and exit rules, offering a balance between safety and strong returns.

The instructor will walk you through:

-

Why volatility investing beats traditional stock trading.

-

The logic behind using short vertical spreads for VXX.

-

Trade optimization based on historical backtests.

-

Exact parameters for strike selection, timing, and expiration.

-

When to activate the hedge using VIX options for additional safety.

You’ll also learn how to identify ideal market conditions, ensuring you deploy this strategy only when probabilities are stacked in your favor.

What You’ll Gain

By the end of this course, you’ll have a complete volatility income system you can execute with confidence:

✅ Weekly Trading Plan: Step-by-step rules for entries, exits, and management.

✅ Predictable Results: Backtested edge verified in multiple market cycles.

✅ Low Stress: Simple “set and wait” structure — no complicated adjustments.

✅ Defined Risk: Built-in position limits that protect against volatility spikes.

✅ Scalable Returns: Works for small accounts and scales easily for larger portfolios.

This strategy empowers you to trade volatility professionally, achieving the consistency that most traders only dream about.

Course Overview

-

Background and instructor experience

-

Understanding price action: VIX vs. VXX

-

Why volatility is a superior asset class for consistent profits

-

Key risks in volatility trading and how to mitigate them

-

Instruments used in volatility markets (VIX futures, ETNs, and options)

-

Fundamentals of VIX Futures Term Structure

-

In-depth breakdown of Contango, Backwardation, and Roll Yield

-

Detailed trading approach and setup rationale

-

Statistical edge and optimization testing

-

Options trading rules for the Plain Vanilla (Mechanical) setup

-

Advanced options strategy rules for additional profit potential

-

Hedging strategy using VIX options

-

Real trade examples and historical results

-

Updated backtests for high-volatility years (e.g., 2018)

Each topic is explained in practical, trader-friendly terms, ensuring you understand not just how to trade, but why it works.

Included Materials and Tools

📘 Course PDF & Trade Rules

A complete manual outlining every rule, rationale, and adjustment procedure.

📊 Backtest Results

Historical performance analysis covering both calm and volatile years.

💻 ThinkorSwim Tools

-

Contango Level Indicator – Identify ideal volatility curve conditions.

-

IV Rank Indicator – Measure implied volatility to fine-tune entries.

📂 Live Trade Examples

Real trading data and ongoing performance updates, including 2018 backtests and trade result updates through December and May.

Instructor Background

The creator of My Options Edge is a professional trader specializing exclusively in volatility strategies using VIX, VXX, and related derivatives. After years in stock, options, and forex markets, he transitioned fully into volatility trading — building a career around predictable, data-backed income systems.

He’s also the author of The Volatility Trading Plan, an Amazon-published book recognized for its clarity and real-world application. Through his courses and trading community, he helps thousands of traders master volatility as an asset class and achieve consistent profitability without emotional stress.

His teaching philosophy is simple: turn volatility from your enemy into your paycheck.

Final Thoughts – Weekly Income with Measured Risk

The Stock Options Strategy: VXX Short Vertical (Mid/High Risk) by My Options Edge is one of the most straightforward and profitable volatility systems available today. By combining short vertical spreads with a protective hedge, you’ll generate reliable weekly income while maintaining control over your risk.

You don’t need to predict market direction or stare at charts all day — just follow the defined rules, place your trades, and let time decay and volatility structure work in your favor.

👉 Join now and take the first step toward mastering volatility and creating consistent weekly income with confidence.

Reviews

There are no reviews yet.