Low-Risk Volatility Options Income Strategy — Learn The CROC Trade v2.0, A Defensive Options Strategy On VXX Designed By My Options Edge To Generate Steady Monthly Income

Instant Download Stock Options Strategy: The CROC trade (low risk) by My Options Edge – Includes Proven Content:

Stock Options Strategy: The CROC Trade (Low Risk) by My Options Edge – You Can Watch This Video Sample for Free to Know More Information:

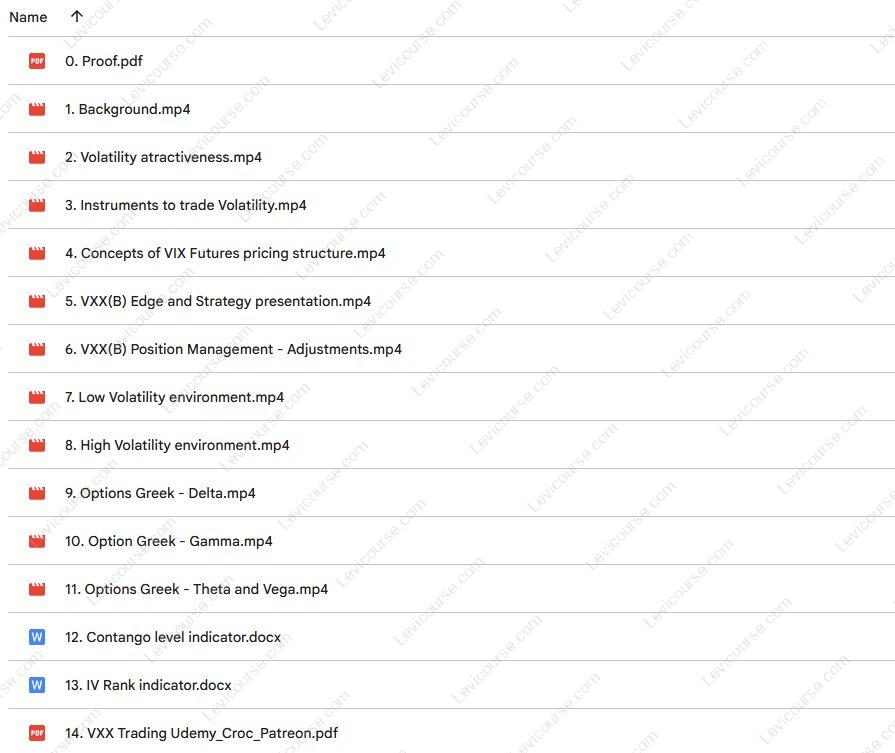

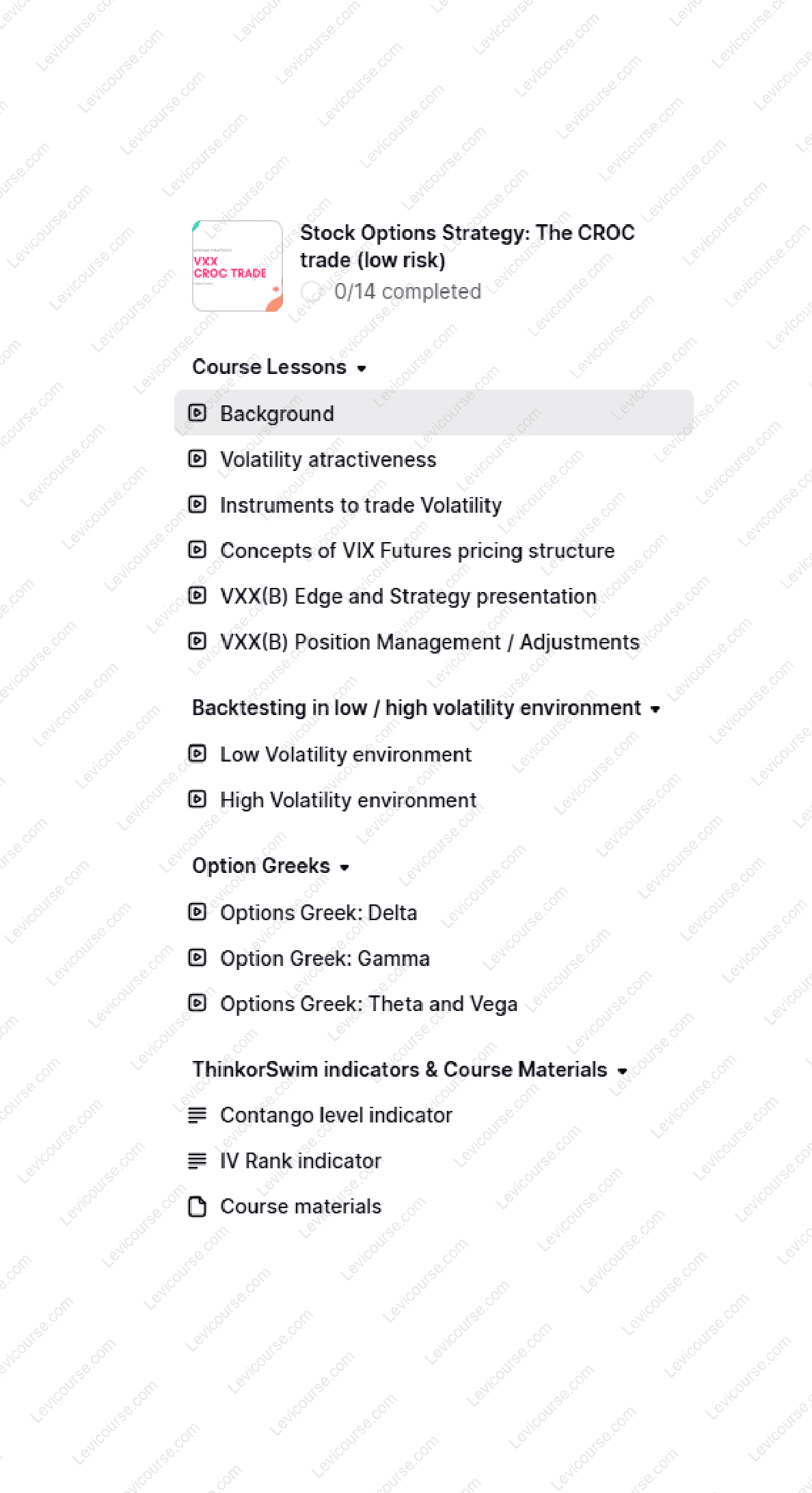

You Can Also Check The Content Proof below to Catch A Glimpse of The Content Inside:

Stock Options Strategy: The CROC Trade (Low Risk) by My Options Edge – Generate Monthly Income Safely with VXX Options

The CROC Trade by My Options Edge is a low-risk, high-consistency stock options strategy designed to capture steady monthly income from VXX, while remaining protected from sudden volatility spikes. Built on years of experience trading volatility, this rule-based method combines the decay of volatility ETNs with options time decay to create a safe, Theta-positive income stream.

About the Program

The Stock Options Strategy: The CROC Trade (Low Risk) was created for traders seeking a proven and mechanical system that consistently generates returns with limited risk. It’s based on VXX, one of the most traded volatility products in the world, and engineered to take advantage of its long-term price decay — while minimizing exposure to volatility explosions.

This system, nicknamed “CROC” (v2.0) due to its distinctive payoff curve, was developed after the success of My Options Edge’s previous volatility courses. Students asked for a strategy that could protect against volatility spikes yet still harness VXX’s decay — and the CROC Trade was the result.

The best part? It’s simple, powerful, and low maintenance. Once you understand the setup, you don’t have to monitor the position daily.

Why the CROC Trade Works

Volatility ETNs like VXX are designed to track short-term VIX futures — but due to contango and roll yield, they naturally lose value over time. Most traders try to short volatility directly and end up with painful drawdowns when markets spike. The CROC Trade solves this problem by blending option spreads and protective structures that limit upside risk, creating a self-hedged position that profits from VXX’s long-term decline and the passage of time.

Here’s what makes it special:

✅ Limited Upside Risk:

Built-in protection against sudden volatility explosions — the trade is structured to hedge itself automatically.

✅ Controlled Downside Exposure:

Risk is defined and managed carefully through precise strike placement.

✅ Theta Positive:

The position gains value from time decay, allowing traders to earn income steadily.

✅ Delta Neutral Bias:

Low sensitivity to directional movement reduces emotional decision-making and overtrading.

✅ Consistent Monthly Profits:

The combination of volatility decay and options Theta produces smooth returns across varying market conditions.

✅ IRA-Compatible:

The strategy can be executed in retirement accounts, offering a conservative yet rewarding setup.

Who This Strategy Is For

You should take this course if you:

-

Have basic options knowledge but lack a proven, rule-based strategy to apply.

-

Have struggled with inconsistent results using technical indicators or stock swing trading.

-

Want to avoid high-risk volatility shorts and still profit from VXX’s decay.

-

Seek a mechanical trading system with clear entry, management, and exit rules.

-

Desire consistent monthly income with minimal monitoring.

If you’re tired of guesswork and want a method that actually works in real markets, the CROC Trade offers the structure and confidence you’ve been looking for.

Inside the Strategy

This course starts by grounding you in the fundamentals of volatility trading — understanding the VIX index, VXX behavior, futures term structure, and how contango and backwardation shape price movements. You’ll learn why volatility investing can be more rewarding and stable than trading individual stocks or forex pairs.

From there, the instructor walks you through the construction of the CROC Trade — explaining the rationale, options dynamics, and trade structure in clear, step-by-step terms. You’ll see exactly how to open, manage, and close positions with minimal adjustments.

Unlike traditional setups that require constant oversight, this strategy was designed for low maintenance. Once entered, it can run independently, freeing you from daily stress and endless chart watching.

You’ll also explore:

-

How volatility spikes affect VXX and how the CROC structure defends against them.

-

Practical trade management rules, including time-based and price-based adjustments.

-

How to identify optimal times to enter new trades based on market conditions.

-

Backtested results showing performance in both high and low volatility environments.

Each lesson builds your understanding step by step — from market behavior to trade execution — ensuring you’re confident applying the system yourself.

What You’ll Gain

By the end of this course, you’ll have a fully operational volatility income strategy that:

✅ Generates steady monthly returns using the decay of VXX.

✅ Is hedged automatically against volatility spikes.

✅ Requires minimal monitoring and no guesswork.

✅ Helps you trade with discipline and consistency.

✅ Provides a mechanical trading plan you can follow for years.

This strategy is perfect for traders who value peace of mind and prefer systematic income over speculative bets.

Course Content Overview

-

Instructor background and trading experience

-

Price action comparison: VIX index vs. VXX

-

Why volatility trading offers superior opportunities

-

Understanding volatility trading risks and how to manage them

-

Instruments used in volatility markets

-

VIX futures structure and pricing

-

The role of contango, backwardation, and roll yield

-

Detailed presentation of the CROC Strategy

-

Strategy characteristics, logic, and protective dynamics

-

Trade management rules and adjustments

-

Backtesting in both calm and volatile markets

-

Deep dive into option Greeks — Delta, Gamma, Vega, and Theta

-

Tools for ThinkorSwim (IV Rank & Contango Indicators)

-

Full course materials and templates for execution

You’ll also get real trade examples showing how the CROC Trade behaves under different volatility conditions — making it easy to replicate in your own account.

Included Tools and Resources

📘 Strategy PDF & Course Materials

Complete step-by-step guide to implementing the CROC Trade independently.

📊 Backtesting Data & Examples

Visual results from historical market conditions.

💻 ThinkorSwim Indicators

-

Contango Level Indicator – Measure futures curve steepness to optimize entries.

-

IV Rank Indicator – Track implied volatility efficiently.

These tools ensure you’re entering trades with precision and managing them based on objective market data.

Meet Your Instructor

The creator of My Options Edge is a professional volatility trader with years of experience trading derivatives based on the VIX index and volatility ETNs. He’s also the author of The Volatility Trading Plan, a highly regarded book among serious volatility traders.

After leaving behind forex and stock trading, he dedicated his career to volatility strategies that deliver consistent, controlled income. Every method he teaches has been tested, refined, and traded live — including the CROC Trade, which he continues to trade himself.

His teaching philosophy is simple: “Keep it mechanical, keep it profitable.”

Final Thoughts – Consistent Income, Controlled Risk, Complete Confidence

The Stock Options Strategy: The CROC Trade (Low Risk) by My Options Edge is the perfect blend of simplicity, safety, and performance. It gives traders the tools to earn steady income from volatility while sleeping peacefully at night.

Instead of fighting unpredictable price swings, you’ll harness the natural decay of volatility — with built-in protection from sudden spikes. No daily monitoring, no stress, no complex indicators — just a repeatable, time-tested system designed for consistency.

👉 Join now and take the first step toward building a reliable monthly income with one of the most powerful volatility options strategies available today.

Reviews

There are no reviews yet.