Low-Risk Volatility Trading System — Master A Proven Stock-And-Options Strategy That Profits From The Natural Decay Of Volatility ETNs Like VXX And UVXY

Digital Download Stock & Options Strategy: Volatility Surf Trade (low risk) by My Options Edge – Includes Necessary Content:

Stock & Options Strategy: Volatility Surf Trade (Low Risk) by My Options Edge – You Can Watch This Introduction Video Sample for Free to Know More Information:

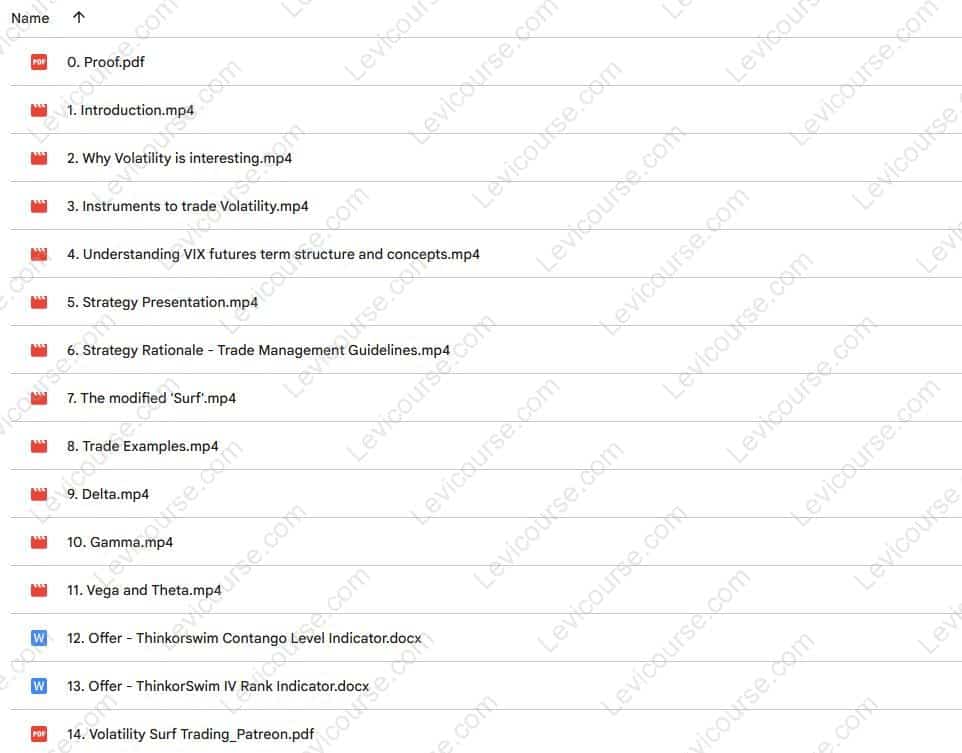

Stock & Options Strategy: Volatility Surf Trade (Low Risk) by My Options Edge – You Can Also View The Screenshot below to Catch A Glimpse of The Content Inside:

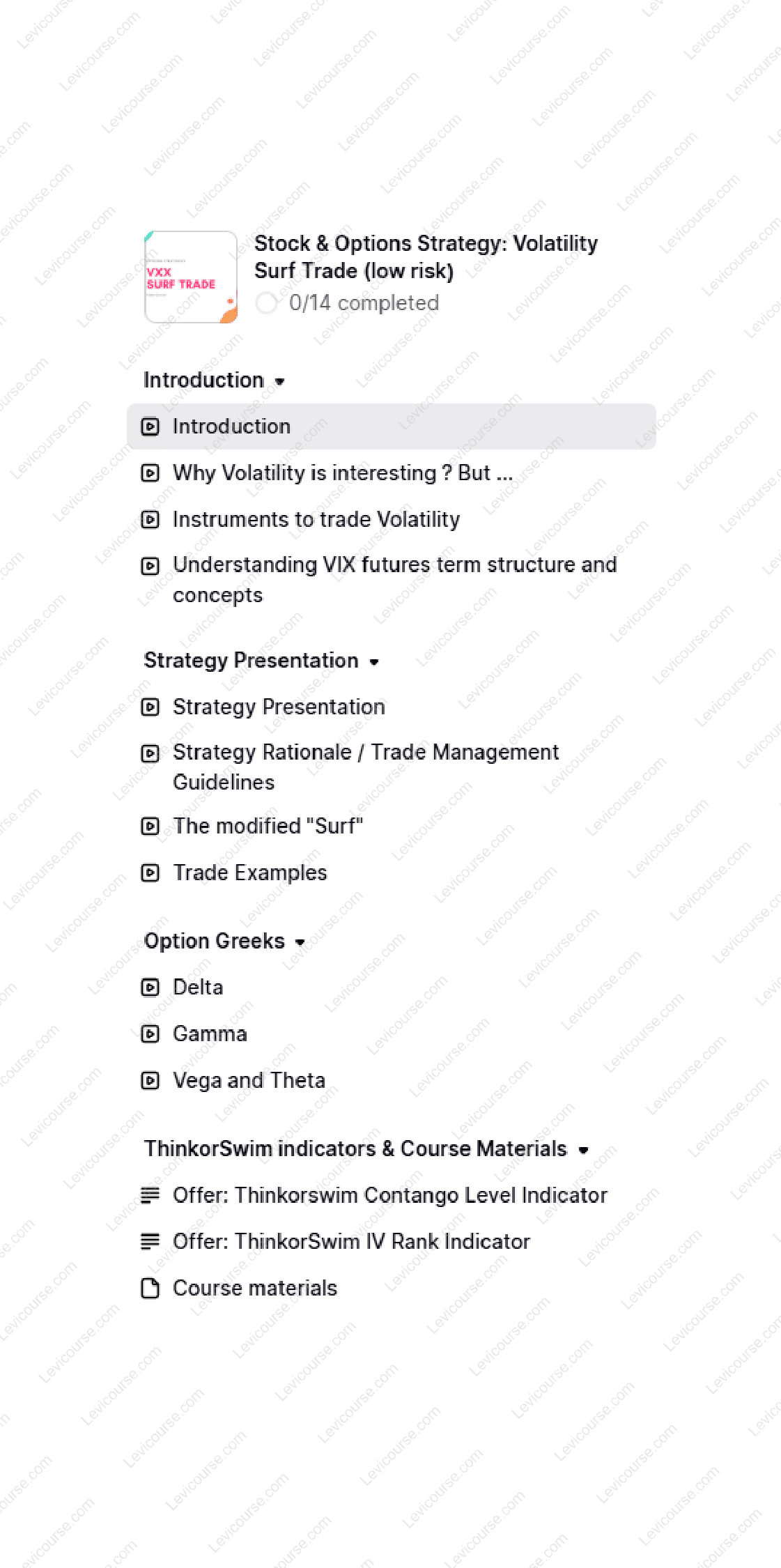

Stock & Options Strategy: Volatility Surf Trade (Low Risk) by My Options Edge – And Finally, You Can Check The Content Proof Here:

Stock & Options Strategy: Volatility Surf Trade (Low Risk) by My Options Edge – Harness the Power of Volatility with Confidence

The Volatility Surf Trade by My Options Edge is a practical, low-risk strategy that merges stocks and options to profit from the natural price decay of volatility ETNs like VXX and UVXY. Designed for traders seeking consistency without stress, it’s a simple, data-driven system built on real market behavior — no technical indicators, no guesswork, and no complicated adjustments.

About the Program

The Stock & Options Strategy: Volatility Surf Trade (Low Risk) offers a rare combination of simplicity, safety, and profitability. It’s not a theory course — it’s a real strategy actively traded by the instructor and shared with full transparency through the My Options Edge community.

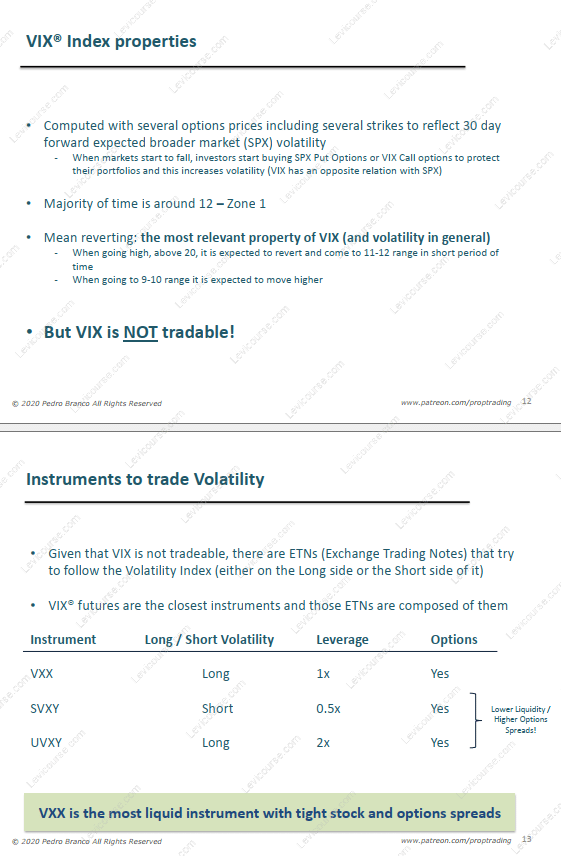

This strategy focuses on the behavior of volatility exchange-traded notes (ETNs) — particularly VXX and UVXY — which lose value over time due to the structural effects of contango and roll yield in the volatility futures market. The result? A consistent opportunity to profit from a predictable long-term trend of decline.

Instead of relying on charts, patterns, or signals that fail when volatility spikes, this method builds its edge on the mathematics of volatility decay. It’s a set of rules you can follow step-by-step — a true mechanical trading plan.

Why Trade Volatility?

Volatility is one of the most misunderstood yet profitable areas of the market. Most traders focus on stocks or forex, where competition is fierce and randomness rules the day. Volatility products, on the other hand, are structured differently — they are derivatives of derivatives, and their price movements follow specific, measurable patterns.

While many traders try to “short volatility” and suffer huge drawdowns when volatility spikes, the Volatility Surf Trade is designed to ride the waves safely. You’ll learn to combine a stock position with carefully chosen options to protect your capital and amplify returns.

Unlike traditional setups that depend on predicting direction, this strategy benefits from time decay and predictable structural inefficiencies — offering you a clear statistical edge.

What Makes This Strategy Unique

The Volatility Surf Trade is not about luck or timing; it’s about structure and precision. Here’s why it stands apart:

-

Proven Market Edge:

The system capitalizes on the mathematical decay of volatility ETNs, something that happens with clockwork regularity due to the futures curve. -

Low Risk & High Consistency:

It’s designed to minimize drawdowns, with clear stop-loss and exit parameters that protect your capital during volatility spikes. -

Fully Mechanical:

Every entry, exit, and adjustment is rule-based — perfect for traders who want clarity, discipline, and freedom from emotional decision-making. -

Simple Yet Scalable:

Works with small accounts starting at just $400, but scales effectively for larger portfolios. -

Backtested & Live-Traded:

The instructor uses this exact system in live markets, sharing real trade examples, results, and updates.

Inside the Strategy

The course begins by teaching the fundamentals of volatility analysis, ensuring you understand the concepts behind VIX futures, term structures, contango, and backwardation. You’ll learn how these forces shape the movement of volatility ETNs and how to identify the best opportunities to “surf” the natural erosion in their prices.

Next, you’ll move into the Volatility Surf framework, where you’ll discover how to blend stock positions with options to create a balanced trade. The system uses a long stock / protective options combo that thrives during quiet markets and shields you during volatility spikes.

To enhance your understanding, the instructor also introduces a “Modified Surf” — a slightly higher-risk variant designed to profit from sudden volatility surges. Both strategies come with full rule sets, including entry criteria, management plans, and clear exits.

You’ll also explore critical topics like:

-

Volatility trading risks and how to mitigate them.

-

How contango and roll yield generate consistent profit opportunities.

-

Selecting the best volatility instruments for your account size and trading style.

-

Managing multiple trades with minimal time and stress.

Finally, you’ll see real trade examples, demonstrating exactly how these rules apply in live markets. Each example includes trade logic, setup rationale, and outcome analysis — turning theory into real-world confidence.

What You’ll Gain

✅ Clarity & Structure — Trade using a repeatable plan instead of gut instinct.

✅ Consistent Income Potential — Generate steady returns by exploiting volatility decay.

✅ Protection from Market Noise — Built-in hedging prevents large drawdowns.

✅ Confidence & Control — Know exactly when to enter, hold, and exit your trades.

✅ Portfolio Enhancement — Add an uncorrelated income stream that strengthens your portfolio’s performance.

This course also gives you a deeper understanding of how options Greeks — Delta, Gamma, Vega, and Theta — interact in volatility-based trades, helping you manage exposure like a professional.

Included Resources

📘 Course Materials

Access the full strategy PDF, outlining every rule in a clear, step-by-step format.

📊 Backtests & Trade Data

Review years of historical tests and performance metrics to validate the system’s consistency.

💻 ThinkorSwim Custom Indicators

Receive exclusive tools such as:

-

Contango Level Indicator: Measure futures curve conditions to identify ideal entry points.

-

IV Rank Indicator: Gauge implied volatility to determine when volatility products are overpriced or undervalued.

📂 Additional Resources

Download templates, sample trade sheets, and reference materials to apply the system immediately in your own trading account.

Why This Course Works

Most courses teach complex setups that rely on precise timing or market prediction. The Volatility Surf Trade removes the guesswork. It gives you a mechanical system based on data, not emotions.

Whether you’re trading part-time or full-time, this method is designed to be low-maintenance and repeatable — you can “set it and forget it,” knowing every trade is grounded in proven logic.

And because the instructor actively trades volatility professionally, you’re not learning from theory — you’re learning from experience.

Who Is the Instructor?

The creator behind My Options Edge is a seasoned volatility trader and educator who has specialized exclusively in volatility strategies for years. After leaving behind traditional stock and forex trading, he focused entirely on volatility derivatives, building a track record of consistent success.

He’s also the author of The Volatility Trading Plan, a widely respected book among traders who want to master volatility as an asset class. His teaching style is direct, data-driven, and accessible — ensuring that even traders with basic options knowledge can apply his methods confidently.

Final Thoughts – Ride the Waves, Don’t Get Caught in Them

The Stock & Options Strategy: Volatility Surf Trade (Low Risk) by My Options Edge gives you a professional-grade volatility system that’s simple enough for anyone to follow. By combining stock and options, you’ll profit from the predictable decay of volatility products — while protecting your capital and freeing yourself from daily market noise.

If you’re ready to replace confusion with clarity and inconsistency with proven results, this course will help you ride the volatility waves with precision and confidence.

👉 Join now and take the first step toward mastering volatility trading with a reliable, rule-based system that works in any market condition.

Reviews

There are no reviews yet.