Free Download Theta Booster by Dan Sheridan – Includes Verified Content:

All About This Practical Options Trading Course With Dan Sheridan Focused On Combining Strategies To Accelerate Time Decay Profits And Recover From Challenging Trades

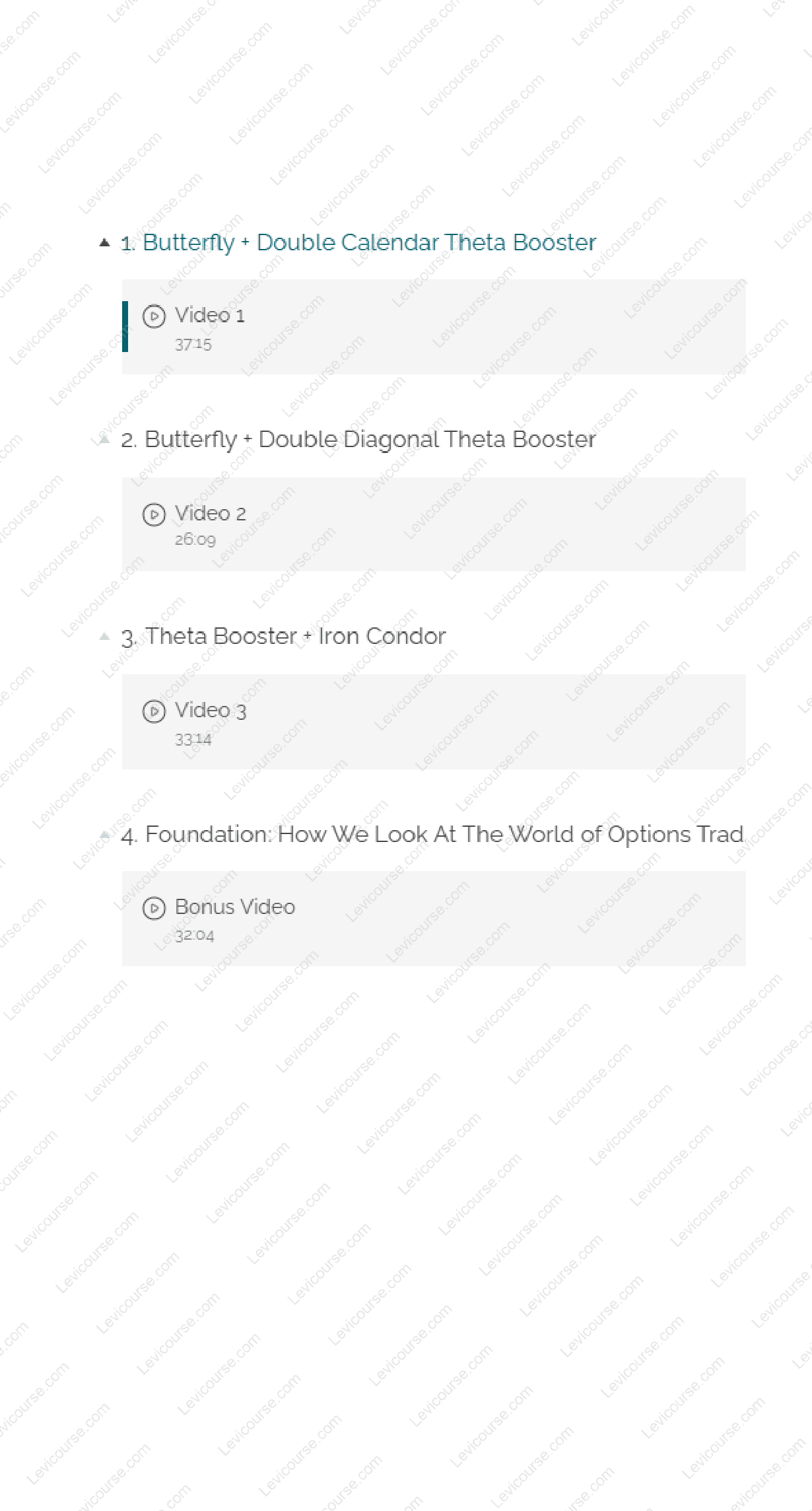

You Can Check The Content Proof below for Free to Catch A Glimpse of The Content Inside:

Theta Booster by Dan Sheridan – Accelerate Your Options Income and Recover Faster

Theta Booster by Dan Sheridan is a focused options trading course that teaches you how to enhance time decay (Theta) returns and recover from tough trades more effectively.

Through a combination of Butterflies, Double Calendars, Double Diagonals, and Iron Condors, Dan shows you how to manage, adjust, and optimize range-bound strategies to accelerate profits while maintaining risk control.

About the Course

In the world of options trading, Theta — the rate of time decay — can be your greatest ally or your biggest frustration.

When markets stall, traders often feel “stuck in rough water,” waiting for time to work in their favor.

The Theta Booster is designed to change that.

Taught by Dan Sheridan, a 25+ year options trading veteran and former CBOE floor trader, this course gives you a systematic approach to enhancing time decay performance, turning slow trades into efficient income generators.

If you trade range-bound strategies like Butterflies, Calendars, or Iron Condors, this course will show you how to boost your Theta while reducing exposure, helping you recover faster and trade with more confidence.

Course Overview

The Theta Booster is part of Sheridan’s Lesson Series — a set of focused, on-demand classes that dive deep into specific trading strategies and adjustments.

In just under two hours, you’ll learn how to transform conventional range-bound setups into powerful, income-producing engines.

Class Specifics

-

🎥 4 on-demand video lessons

-

🕒 Nearly 2 hours of detailed instruction

-

📘 Lifetime access to recordings and class materials

-

🧠 Step-by-step strategy breakdowns with practical examples

Each video lesson focuses on a specific Theta Booster variation, complete with real examples, risk profiles, and adjustment rules.

What You’ll Learn in the Theta Booster Course

Dan Sheridan brings decades of professional trading experience to simplify complex concepts into clear, actionable strategies.

Here’s what you’ll master in this course:

1. Foundation: How We Look at the World of Options Trading

Before diving into the strategies, Dan lays out the core philosophy that guides his approach to trading.

You’ll learn:

-

The difference between directional and non-directional trading.

-

How to think in terms of probability and time decay instead of prediction.

-

The role of range-bound trading in generating consistent monthly income.

-

Why understanding Theta, Vega, and Delta balance is critical for success.

This foundational mindset helps you approach every trade with discipline and structure.

2. Butterfly + Double Calendar Theta Booster

The first strategy combines the Butterfly and Double Calendar — two of the most reliable Theta-positive structures.

You’ll learn how to:

-

Construct a balanced position that thrives in quiet markets.

-

Use the Butterfly for profit capture and the Double Calendar for flexibility.

-

Manage the trade dynamically as volatility shifts.

-

Adjust positioning to recover quickly from adverse moves.

This hybrid setup gives traders the ability to stay profitable in slow, sideways conditions, while still allowing for controlled adjustments when volatility expands.

3. Butterfly + Double Diagonal Theta Booster

In this lesson, Dan introduces the Double Diagonal, a powerful Vega-sensitive position, and pairs it with the Butterfly for added stability.

Key takeaways include:

-

How to structure the Double Diagonal to capture wider ranges.

-

Using the Butterfly to fine-tune Theta exposure and flatten Delta.

-

How to benefit from both time decay and volatility contraction.

-

Managing Greeks effectively to stay neutral and adaptable.

This combination works exceptionally well when implied volatility fluctuates, allowing you to take advantage of both time and volatility shifts simultaneously.

4. Theta Booster + Iron Condor

The final module covers one of Dan’s most popular hybrids — The Theta Booster with an Iron Condor.

This approach merges the simplicity of the Iron Condor with advanced techniques for Theta acceleration.

You’ll learn how to:

-

Build a low-stress Iron Condor enhanced with Theta-focused positioning.

-

Adjust wing widths and deltas to maximize time decay.

-

Identify ideal entry timing to capture consistent Theta flow.

-

Apply repair methods to recover from losing positions faster.

By the end of this section, you’ll have a flexible, income-producing structure that can perform in both neutral and slightly trending markets.

Why the Theta Booster Works

The Theta Booster method is effective because it leverages multiple sources of positive Theta while maintaining Delta neutrality and controlled Vega exposure.

Each variation — whether combined with a Butterfly, Calendar, or Condor — provides:

-

Stable income generation from time decay.

-

Built-in flexibility for different volatility environments.

-

Lower psychological stress, since positions are non-directional.

-

Defined risk and easy adjustment rules, minimizing surprises.

This makes it an excellent choice for retail traders seeking steady income or professional traders refining advanced hedging tactics.

Key Benefits of the Theta Booster

Here’s what sets this course apart:

✅ Practical, real-world setups used by experienced traders.

✅ Detailed trade management rules for every environment.

✅ Low-maintenance strategies with clear adjustment triggers.

✅ Suitable for all account sizes, from small retail accounts to larger portfolios.

✅ Lifetime access, allowing you to revisit and refine techniques anytime.

The goal is to turn your understanding of Theta into a measurable income edge.

Who Should Take This Course

The Theta Booster by Dan Sheridan is ideal for:

-

Intermediate to advanced options traders who already use non-directional spreads.

-

Income traders seeking to accelerate returns from Theta.

-

Traders stuck in stagnant positions who want to recover faster.

-

Investors looking for a lower-stress, systematic approach to consistent profits.

If you trade Butterflies, Calendars, or Condors — this course will help you optimize and integrate them for maximum Theta efficiency.

About the Instructor – Dan Sheridan

Dan Sheridan is a veteran options trader and founder of Sheridan Options Mentoring, with over 30 years of experience in professional trading and education.

A former CBOE floor trader for Chicago’s largest firms, Dan now dedicates his career to teaching traders around the world how to manage risk and generate consistent income through options strategies.

Known for his hands-on mentorship style and focus on real-world applications, Dan has trained thousands of successful traders and continues to lead one of the most respected options education communities in the world.

About Sheridan Options Mentoring

Founded by Dan Sheridan, Sheridan Options Mentoring (SOM) is a leading provider of options education programs.

Their mission is to help traders build confidence through personal mentorship, live examples, and structured learning.

Every course, including Theta Booster, focuses on clarity, consistency, and real trading success, rather than complex theory or unrealistic expectations.

Final Thoughts – Boost Your Theta, Boost Your Edge

Theta Booster by Dan Sheridan gives traders the tools to amplify time decay income and navigate tough markets with confidence.

Through innovative combinations like Butterfly + Calendar, Butterfly + Diagonal, and Condor hybrids, you’ll learn how to extract more profit while reducing drawdowns and emotional stress.

👉 Enroll now and discover how to turn Theta — the silent force of options — into your most consistent and powerful ally.

Reviews

There are no reviews yet.