Free Download Geometric Angles Applied To Modern Markets By Sean Avidar – Includes Verified Content:

All About This In-Depth Trading Course Exploring W.D. Gann’s Geometric Angle Methodology And Its Application To Today’s Markets

Geometric Angles Applied To Modern Markets by Sean Avidar – Unlocking W.D. Gann’s Timeless Market Geometry

Geometric Angles Applied To Modern Markets by Sean Avidar is a deep-dive trading course that modernizes W.D. Gann’s legendary geometric angle theories for today’s financial markets.

Learn how to measure time and price proportionally, identify turning points, and forecast high-probability moves using the same geometric principles that shaped Gann’s revolutionary trading approach.

About the Course

For nearly a century, traders have been fascinated by W.D. Gann’s geometric methods, which link market movements to mathematical precision and natural law.

Sean Avidar revives and refines these principles in Geometric Angles Applied To Modern Markets, showing traders how to apply them with modern tools and real-time market analysis.

This comprehensive program bridges classical Gann theory with contemporary trading practice, teaching you to read charts geometrically — the way Gann himself intended.

By the end of the course, you’ll be able to apply geometric time and price analysis to any market, timeframe, or instrument.

W.D. Gann’s Geometric Legacy

William Delbert Gann (1878–1955) was one of history’s most enigmatic and successful traders.

He believed that markets follow natural geometric and cyclical laws, and that price and time could be forecasted through proportional relationships.

Gann’s tools — from his famous “Square of 9” to geometric angles — were based on the belief that:

“When time and price square, change is inevitable.”

His methods used protractors, compasses, and rulers to measure angles of movement, creating precise geometric frameworks to anticipate support, resistance, and trend changes.

While controversial and often misunderstood, Gann’s geometry continues to inspire traders worldwide — and this course makes it practical for the modern era.

What You’ll Learn in This Course

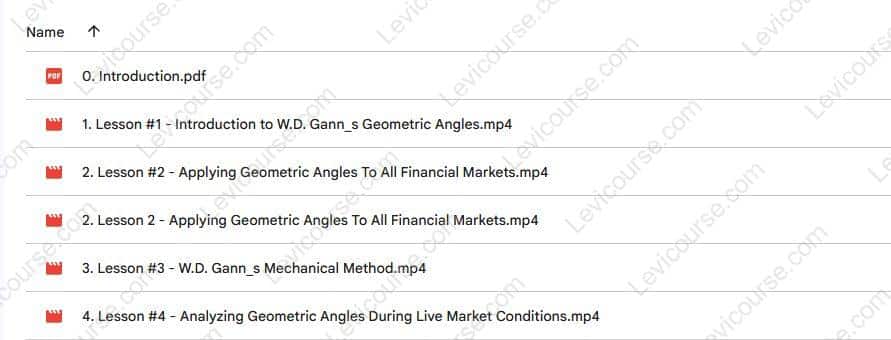

Sean Avidar’s Geometric Angles Applied To Modern Markets breaks down Gann’s complex theories into four structured lessons.

Each lesson combines theoretical understanding with real-world market application.

Lesson 1 – Foundations of Gann’s Geometric Angles

Start with a solid grounding in Gann’s original geometric framework and how it translates to today’s markets.

You’ll learn:

-

Introduction to W.D. Gann’s Geometric Angles – the foundational theory behind time-price relationships.

-

The Role of the Square in Nature – understanding how geometry governs natural and market cycles.

-

Using the Square to Divide Time and Price Proportionally – scaling tools for balanced market analysis.

-

Identifying Key Angles Within the Square – the geometric foundations of support and resistance.

-

Common Scaling Problems – why most traders misapply Gann’s tools.

-

How to Scale Charts for All Markets and Timeframes – modern methods for accurate proportional charting.

This lesson sets the stage for precise geometric chart interpretation.

Lesson 2 – Scaling and Timekeeping Mastery

Discover how to properly scale markets using Gann’s “timekeeper” concept, which balances time and price symmetrically.

Topics include:

-

What Is a Timekeeper? – understanding how time governs geometric relationships.

-

Using Timekeepers to Scale Charts Across All Timeframes.

-

Solving Geometric Angles for Multiple Markets.

-

Squaring Highs and Lows Using Geometric Angles.

-

Interpreting Price Action Around Geometric Angles.

By the end of Lesson 2, you’ll know how to align time, price, and structure — revealing the “hidden order” in every chart.

Lesson 3 – Gann’s Mechanical Method and Trade Application

Here, Sean Avidar translates Gann’s mechanical trading method into actionable strategies for modern traders.

You’ll learn to:

-

Apply Gann’s Mechanical Method using geometric angles.

-

Identify precise buying and selling points using time-price intersections.

-

Build entries and manage positions geometrically.

-

Analyze market geometry to determine trend continuation or reversal zones.

-

Apply effective trade management and risk control with geometry-based logic.

This lesson transforms Gann’s abstract theories into repeatable trading rules for real-world execution.

Lesson 4 – Live Market Analysis with Geometric Angles

Theory meets practice. In this live trading session, you’ll see how geometric principles reveal structure and timing across multiple assets.

You’ll explore:

-

Top-Down Analysis using geometric angles — from higher to lower timeframes.

-

Identifying Market Sections and Cycles – understanding the rhythm of price.

-

Evaluating Possible Market Scenarios – mapping potential turning points.

-

Speculating on the Next Probable Move – forecasting with high precision using Gann’s geometry.

By combining time, price, and structure, you’ll gain the tools to forecast market reactions before they happen.

Key Skills You’ll Gain

After completing Geometric Angles Applied To Modern Markets, you’ll have mastered:

✅ Gann’s geometric scaling methods for time and price.

✅ Charting and interpreting key geometric angles.

✅ Identifying cyclical turning points and structural reversals.

✅ Applying geometry to live markets and trade execution.

✅ Using Gann’s mechanical methods for risk-managed entries and exits.

✅ Performing top-down market analysis through geometric mapping.

You’ll walk away with a systematic, visual approach to trading — combining mathematical precision with market intuition.

Why This Course Is Unique

Sean Avidar’s approach stands out because it bridges classical geometry with modern trading platforms.

Unlike many Gann courses that focus on theory, this course:

-

Converts Gann’s angles into practical tools you can apply on real charts.

-

Teaches scaling and proportional analysis across multiple timeframes.

-

Explains why geometric relationships matter and how to use them effectively.

-

Includes live market demonstrations, ensuring you see theory in action.

This isn’t just another historical overview — it’s a functional education in geometric market analysis.

Who This Course Is For

This course is perfect for:

-

Technical traders seeking to deepen their understanding of price geometry.

-

Gann enthusiasts wanting to learn practical applications for modern platforms.

-

Swing and position traders looking for advanced timing tools.

-

Analysts and educators exploring mathematical forecasting models.

-

Anyone interested in the intersection of natural law, geometry, and financial markets.

If you’ve ever wondered how to bring precision, proportion, and structure to your analysis — this is your roadmap.

About the Instructor – Sean Avidar

Sean Avidar is a professional trader and educator specializing in market geometry and Gann analytics.

With years of experience decoding W.D. Gann’s techniques, Sean has developed a clear, practical framework for applying these timeless principles to modern electronic markets.

His teaching combines classical theory, mathematical precision, and modern technology, helping traders integrate Gann’s ideas into day trading, swing trading, and institutional-style analysis.

Final Thoughts – Bring Geometry Back to Your Charts

Geometric Angles Applied To Modern Markets by Sean Avidar gives you a rare opportunity to rediscover W.D. Gann’s genius — translated for the digital age.

By understanding the geometric relationship between time and price, you’ll uncover hidden harmonies that guide every market move.

👉 Enroll now and start applying Gann’s geometric methods to your charts — bringing new precision, timing, and confidence to your trading decisions.

Reviews

There are no reviews yet.