Free Download Algorithmic Trading Systems Education Course by Capstone Trading – Includes Verified Content:

Algorithmic Trading Systems Education Course by Capstone Trading – All About This Comprehensive Algorithmic Trading Program

Algorithmic Trading Systems Education Course by Capstone Trading – You Can Watch This Video Sample for Free to Know More Information:

Algorithmic Trading Systems Education Course by Capstone Trading – You Can Also View The PDF Sample below to Catch A Glimpse of The Content Inside:

Algorithmic Trading Systems Education Course by Capstone Trading – And Finally, You Can Check The Content Proof Here:

Algorithmic Trading Systems Education Course by Capstone Trading – Advanced Futures Strategies for Serious Traders

The Algorithmic Trading Systems Education Course by Capstone Trading is an advanced, hands-on program that teaches traders how to develop and automate profitable gap strategies for the futures markets.

Based on David Bean’s proven “Algorithmic Trading Systems” methodology, this course provides open-source code, platform setups, and over 40 instructional videos covering everything from system logic to live automation—so you can trade like the pros on Wall Street.

Why This Course Is Different

Most trading courses show theory or individual setups without giving you the complete system.

The Algorithmic Trading Systems Education Course goes beyond strategy—it gives you the actual tools, code, and automation setups used to execute professional-level trades on multiple platforms.

Created by David Bean of Capstone Trading Systems, this course reveals tested algorithms, coding techniques, and system principles that challenge Wall Street myths and help you build a consistent, data-driven edge.

Here’s what makes it stand out:

-

Multi-Platform Integration: Full setup instructions for TradeStation, NinjaTrader 7, and NinjaTrader 8.

-

Open Code Access: Includes editable C# NinjaScript and EasyLanguage source code.

-

Real Backtesting Data: Learn from algorithms that have been verified across multiple futures markets.

-

Systematic Process: Step-by-step automation tutorials—no guesswork or black-box systems.

-

Principles That Defy Convention: Challenge popular trading clichés like “you can’t go broke taking profits.”

If you want to move beyond discretionary trading and step into the world of professional algorithmic systems, this course delivers the structure and sophistication you need.

What You’ll Learn in the Algorithmic Trading Systems Course

This program is a comprehensive blueprint for developing, testing, and deploying algorithmic trading systems designed for futures markets such as the E-mini S&P, Crude Oil, Euro Currency, and DAX.

1. Introduction to the Members Area

-

Overview of the course structure and key materials.

-

How to access your strategy files, code, and videos.

-

Orientation for both beginners and intermediate algorithmic traders.

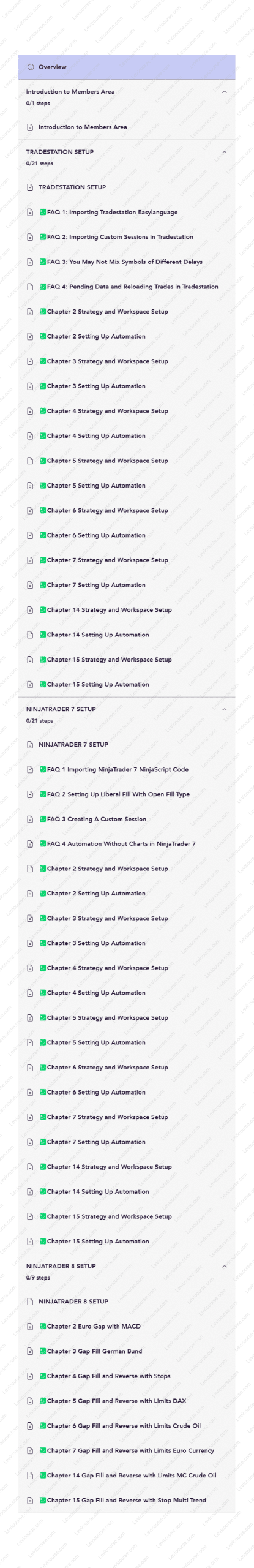

2. TradeStation Setup

Master EasyLanguage automation and backtesting inside TradeStation.

Key lessons include:

-

How to import and configure TradeStation EasyLanguage code.

-

Setting up custom sessions for accurate gap analysis.

-

Understanding symbol delays and trade data syncing.

-

Automation tutorials for each strategy chapter—learn how to test, deploy, and optimize your systems.

-

Creating multiple workspaces and integrating trend filters and exit strategies.

Chapters Covered:

2, 3, 4, 5, 6, 7, 14, and 15 — each with separate “Strategy Setup” and “Automation Setup” videos.

3. NinjaTrader 7 Setup

Learn C# NinjaScript coding and automation techniques for NinjaTrader 7.

You’ll discover how to:

-

Import NinjaScript strategy files and custom indicators.

-

Configure “Liberal Fill” and “Open Fill Type” settings for realistic fills.

-

Create custom trading sessions for 24-hour markets.

-

Automate trading systems without requiring open charts.

-

Build, test, and execute multiple strategies simultaneously.

Chapters Covered:

2–7, 14, and 15, each including full setup and automation guidance.

4. NinjaTrader 8 Setup

Explore next-generation gap strategies with MACD, reversals, and trend filters.

Strategies include:

-

Chapter 2: Euro Gap with MACD Confirmation

-

Chapter 3: Gap Fill German Bund

-

Chapter 4: Gap Fill and Reverse with Stop

-

Chapter 5: Gap Fill and Reverse with Limits (DAX)

-

Chapter 6: Gap Fill and Reverse with Limits (Crude Oil)

-

Chapter 7: Gap Fill and Reverse with Limits (Euro Currency)

-

Chapter 14: Multi-Contract Crude Oil Strategy

-

Chapter 15: Multi-Trend Gap Fill and Reverse with Stops

Each strategy comes with full workspace examples, code explanations, and video walkthroughs to ensure proper setup and execution.

Course Highlights

-

Five Futures Markets Covered: E-mini S&P, DAX, Euro, Crude Oil, and German Bund.

-

C# and EasyLanguage Open Code: Study, edit, and customize proven scripts.

-

40+ Instructional Videos: Detailed explanations of automation logic, trade management, and risk control.

-

Trading System Principles: Learn the core logic behind profitable algorithmic systems.

-

Myth Busting: Why traditional “rules” like “always lock in profits early” can actually limit your gains.

-

Gap Trading Mastery: Discover the advanced “Gap After Fill” pattern—trade once the initial gap is filled for optimal precision.

-

Multiple Exit Strategies: Implement trailing stops, limit orders, and dynamic filters to adapt to changing market conditions.

-

Hands-On Learning: You’ll actually code, test, and automate your systems—developing both technical skill and trader intuition.

Key Learning Outcomes

By the end of this course, you will:

-

Understand how to design and deploy fully automated systems.

-

Learn how to trade gaps after fills, capturing secondary market opportunities.

-

Apply multiple exit and filter conditions for improved consistency.

-

Backtest strategies across several futures instruments.

-

Eliminate guesswork by automating decision-making.

-

Recognize the flaws in conventional Wall Street wisdom and trade with confidence.

This is your chance to access institutional-level knowledge and technology—without needing a Wall Street firm behind you.

Core Features and Benefits

-

Comprehensive Setup Training: Full installation and configuration for TradeStation and NinjaTrader.

-

Open Source Code: Modify and improve strategies as you learn.

-

Algorithmic Education: Understand how strategy logic drives results.

-

Real-World Systems: Tested methods that work across diverse market conditions.

-

Advanced Gap Trading: Learn niche setups used by professional traders.

-

Lifetime Access: Review lessons, rewatch videos, and refine your code at your own pace.

You’ll Gain:

-

Technical fluency in C# and EasyLanguage scripting.

-

A deep understanding of how automation improves consistency.

-

Confidence in backtesting and deploying algorithmic strategies.

-

Practical systems ready to trade across multiple futures markets.

Who This Course Is For

The Algorithmic Trading Systems Education Course is perfect for:

-

Intermediate to advanced traders who want to automate their strategies.

-

Programmers or developers interested in algorithmic finance.

-

Manual traders ready to transition to data-driven decision-making.

-

Futures traders seeking gap-trading strategies with tested logic.

-

Investors who want a systematic approach to trading performance.

If you’re ready to combine technology with trading intelligence, this course is your gateway to professional-grade system development.

About the Instructor – David Bean, Capstone Trading Systems

David Bean, founder of Capstone Trading Systems, is a seasoned algorithmic trader, systems developer, and author of Seven Trading Systems for the S&P Futures and Algorithmic Trading Systems.

For over a decade, David has developed and shared automated trading solutions used by traders worldwide.

His mission is simple: to level the playing field between independent traders and Wall Street institutions by teaching the tools and principles behind successful automated systems.

David’s hands-on approach combines robust backtesting, transparent logic, and accessible code—so traders can build their own edge with confidence.

Final Thoughts – Build, Backtest, and Automate Like a Pro

The Algorithmic Trading Systems Education Course by Capstone Trading is more than just an algorithmic trading class—it’s a full professional toolkit.

You’ll learn how to code, test, and deploy strategies with real logic and open systems that put you in control—not the broker.

From advanced gap fills to multi-exit systems, you’ll gain practical, repeatable skills that give you an edge in the competitive futures markets.

👉 If you’re ready to trade with precision, automation, and confidence, this course will show you how to think—and code—like Wall Street’s best.

Reviews

There are no reviews yet.